Adyen Earnings H2 2023

Total Cost of Ownership – Authorization Rates, Issuing and Global Banking Licenses & Growth

From CNBC:

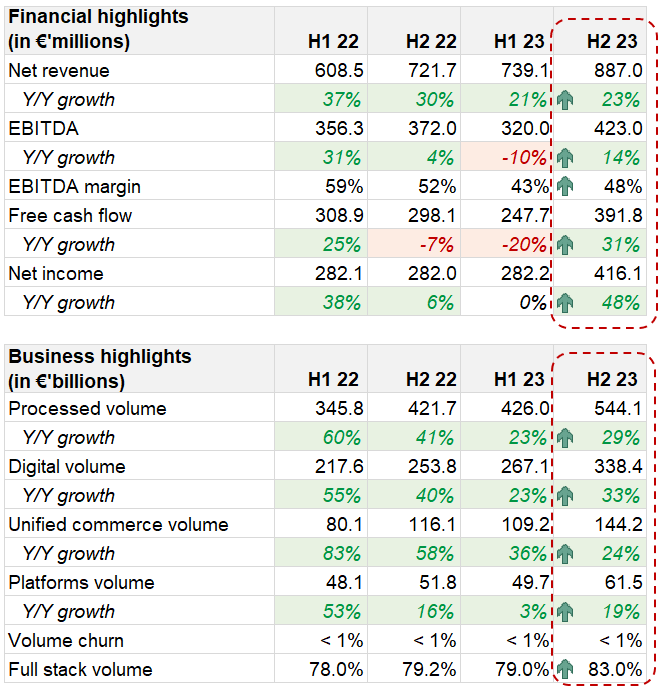

Shares of European online payments giant Adyen jumped on Thursday, after the company reported strong sales growth and better-than-expected profit for 2023.

Adyen, which competes with Stripe, PayPal, and Block, told shareholders in its 2023 annual letter that it had slowed the pace of its hiring to counter concerns that it was spending too aggressively on expanding its team, while its margins were being compressed.

Followers of Adyen will probably remember the near 60% destruction in Adyen’s stock price following the previous earnings report in August 2023. The headwinds at the time were compressing margins from slowing revenue growth due to the competitive and price sensitive environment in North America at a time when the company was simultaneously ramping up hiring. The accelerated hiring was considered to be counter cyclical when the broader tech industry was undergoing mass layoffs. Instead of engaging in a price war, which was arguably a shorter-term solution, management held their ground and focused on lowering the total cost of ownership. This shows management’s long-term conviction by not letting the short-term inconveniences like temporarily compressed margins affect their decision making, especially since they had the capability to win the price war as their single and integrated platform meant they had the lowest cost per transaction. One thing to note though, is that while management is known for having strong conviction, they are still open to the investor community’s input, as seen in the newly incorporated quarterly business updates.

Fast forward to today, the reacceleration of about 27% of net revenue growth in their North America segment in the second half of 2023 is mounting evidence of the strength of Adyen’s total cost of ownership. This then begs the question, how is management improving the total cost of ownership for their customers?

Adyen’s Total Cost of Ownership – Authorization Rates, Issuing and Global Banking Licenses

Since Pieter van Der Does was absent from the call, co-CEO Ingo Uytdehaage explained on the earnings call, on the Unified Commerce, Digital and Platform pillars:

For instance, if you look at Unified Commerce, we've been working with S Group from the Nordics, which is an everyday retailer, that selected us because we can help them both in-store and online, and by doing that, also improving their loyalty offering. And I think that is helping them to drive down the total cost of ownership.

Also on the digital side, where we work for customers, new customers like World Remit, and we also expanded our partnership with Klarna. And then for digital, we help them to reduce fraud, to increase the authorization rates that are very important to our digital customers.

But also on the platform side, if you think about a customer like Centrip, where we help them to embed payments into their offering, but also to expand on the embedded financial products going forward.

Having in-store and online data on a single integrated platform enables merchants to identify shoppers, without the need for a physical loyalty card or any manual registration. Merchants can identify and create a customer profile based on the payment data. This would improve merchants’ loyalty offering by tailoring benefits like discounts, recommendations based on the customer’s specific purchase history.

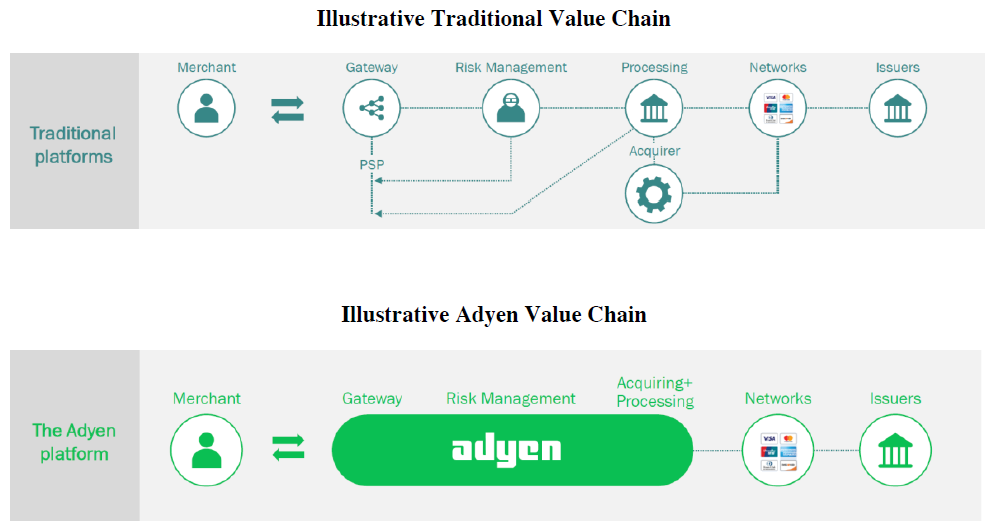

Source: Adyen’s Prospectus

To understand how Adyen improves authorization rates, it’s important to understand Adyen’s role in the value chain. Authorization rate is the number of completed transactions the acquirers have successfully processed after the conversion of payment by a customer. Once the customer has acted upon the payment flow, it is dependent on the connection with the acquirer to receive and process a payment resolution on time. Most payment processors provide these functions too, but they are generally outsourced to several third parties. This would consequently leave a black box for merchants, without significant insight as to why transactions were approved or declined.

Adyen combines the gateway, risk management and processing and acquiring functions to simplify payments for merchants. This enables Adyen to identify and provide a detailed breakdown of refusal reasons including, amongst others, outdated card details, technical errors and bad routing choices, insufficient funds, additional authentication required by some issuers, false positive checks by banks, etc. Adyen then builds features to optimize authorization rates and reduce fraud. The reason authorization rates are so important, particularly considering that Adyen’s customers are generally large merchants, is that each basis point of authorization uplift would result in huge incremental revenue uplifts for the merchant. For example, a 1% increase in authorization rate of Adyen’s total processed volume in FYE 2023 of EUR970.1 billion would result in approximately EUR9.7 billion in incremental revenue. This would also explain why they were ramping up hiring for the past two years. Since Adyen prefers not to do acquisitions, they build all their features in-house and as the complexity of the payments landscape increases, more software engineers are needed to build out more features.

Another up-and-coming financial product is issuing; Ingo on the earnings call:

The other example is how we build out issuing. And I think we have a unique milestone at this half year where we, for the first time, passed the EUR100 million process volume mark, which, of course, is still very tiny if you compare it to our total processed volume, but it shows, it demonstrates how important issuing is in a strategic way to our offering.

Put simply, issuing is providing merchants with a payment method by way of virtual or physical cards, typically from Mastercard or Visa. These payments are typically for either one-off or regular business expenses. Traditionally, in order for merchants to build an issuing card program, they would have to go through traditional banks who would sponsor you as a member of the scheme network and act as an issuer. With this method, merchants would still have to find additional 3rd party providers for the Know-Your-Customer (KYC) and risk management services. In more recent times, there are fintechs that offer an integrated solution by streamlining these solutions together, but the drawbacks are limited innovation due to dependence on traditional institutions, interchange fees as a cost driver (as they usually go to the issuer), and decoupled acquiring, which is when the acquirer and issuer are two separate entities. For example, think of an online travel agent who accepts payments from customers and pays the hotel for bookings – the online travel agent could run into cashflow delays as the gap between hotel booking and collection from customer could be lengthy.

The combination of acquiring and issuing on a single platform offers several benefits. Firstly, by having one partner and integration across multiple continents/regions, merchants can launch in new markets quickly. Secondly, merchants are less restricted by third party providers and legacy infrastructure which allows for faster innovation in terms of features. Thirdly, using the example of the online travel agent, incoming payments from the acquiring side would be instantly available for the issuing side for spending, eliminating the problem of cashflow delays and freeing up working capital.

How Adyen is able to do this is through obtaining banking licenses; here’s Ingo again:

And, of course, we expect to get more going forward. Another topic for a product which has been very important and which is overlooked very often is how we are getting our banking license globally. We now have our banking license also in the UK, which gives us direct access to the clearing in the UK, which also then helps us to improve our payout offering to our merchants, which, of course, is also very important from a product perspective.

As Adyen continues to expand their reach for banking licenses, one could argue that their moat continues to grow. For perspective, here’s an overview of Adyen’s global banking licenses:

Source: Adyen’s Academy

While processing card payments is important, as the complexity around different types of payment methods increases, there’s an increasing importance of other means of payment such as Buy-Now-Pay-Later (BNPL) and domestic bank transfers too. This is also why Adyen generally keeps huge cash reserves on their balance sheet (approximately EUR8.3 billion as at FYE 2023) in order to talk to regulators and maintain their credit rating. And despite some announced customer wins including Cash App, management explained that typically their land and expand strategy should be expected to bear fruit in a few years.

Growth is Not Always Linear

Notwithstanding the broader slowdown in the retail industry for Unified Commerce, Adyen is still considered to be highly underpenetrated in terms of Point of Sale (POS) volumes, which stood around 16% of total processed volumes for FYE 2023 (up from 15% in 2022), compared to around 80-85% in the market.

Further, the operating leverage of the business appears to be kicking in as EBITDA margins improve while hiring slows down; CFO Ethan Tandowsky mentioned on the earnings call:

So while we do expect to expand EBITDA margins in 2024, we don't expect it to be at the same rate as in '25 and '26. And I do think it's important that I mentioned that we don't think that 50% is the limit of what we can get to over time. It's more a timing discussion.

Management also explained that more than 80% of net revenue growth comes from existing customers as opposed to new customers. Keep in mind that larger merchants generally have multiple payment processors as a way to diversify and hedge their risk. They continually test processors by shifting volumes to assess which brings them the most benefit. The fact that Adyen continues to grow, coupled with volume churn remaining below 1% means that they continue to grow their wallet share.