Adyen: Processing More, Earning More

Adyen N.V. (ADYEN) H1 2024 Earnings Analysis

Table of Contents

About Adyen

Business Analysis

Financial Analysis

Earnings Call Highlights

Takeaway

1. About Adyen

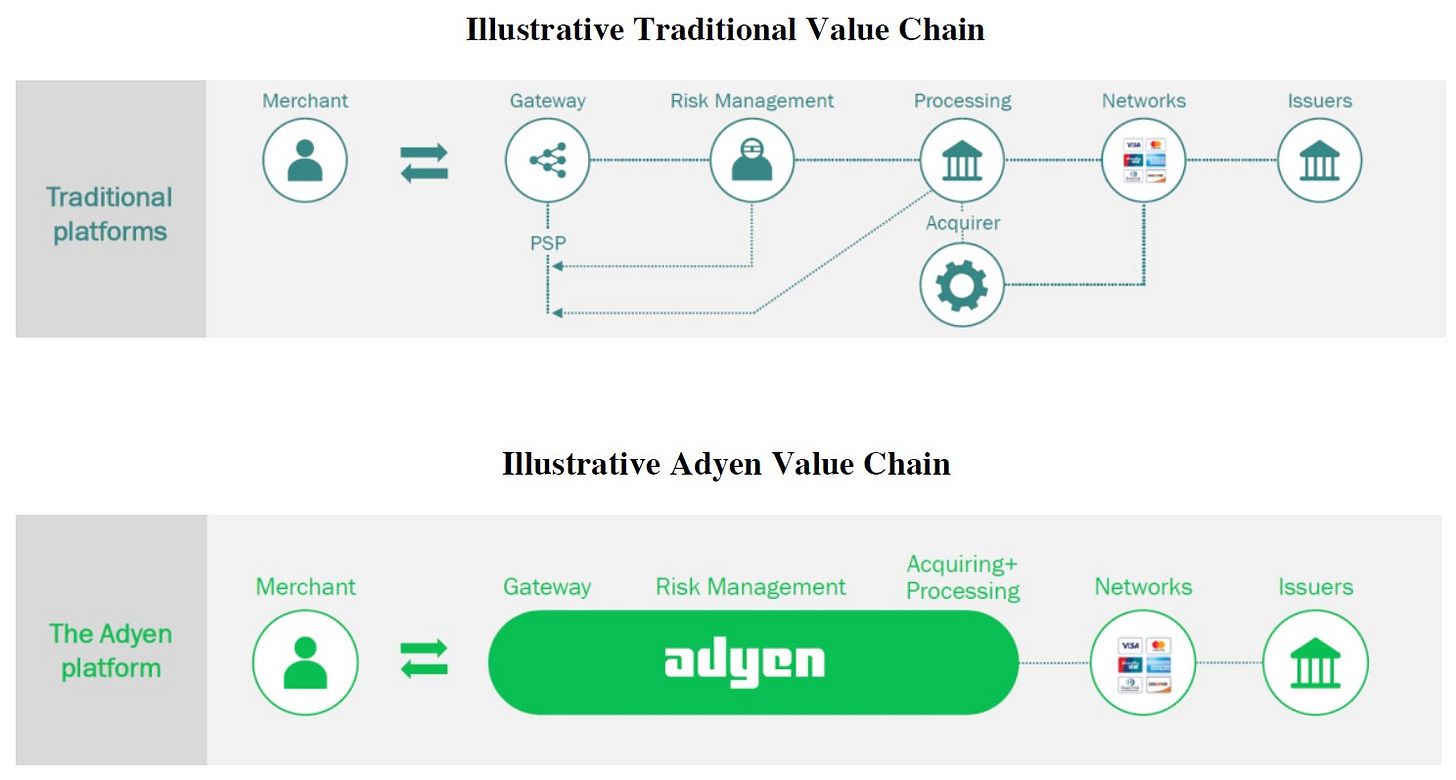

Adyen is a technology company that operates a single, fully-integrated proprietary platform that provides functions in the payments stack including gateway, risk management, acquiring, processing, issuing and settlement services.

The typical payments landscape has been characterized by a fragmented patchwork of providers and legacy systems, where traditional platforms provide for separate gateway, risk management, processing and acquiring solutions. Adyen combines all these functions into one platform.

Traditionally, both payment service providers and merchants have been challenged with in-store and online/mobile payments running on different technology and systems. Adyen's platform has no such limitation, being built as a channel agnostic platform from day one. Adyen's platform provides the same back-end payment processing and settlement infrastructure for merchants whether their shoppers make purchases online, on their phones or in-store.

Traditional payments systems are a so-called 'black box', whereby transactions are either approved or declined – with little insights as to why that happened, especially as payment service providers are only one part of the value chain. In contrast, Adyen's control of the complete payments stack results in a high degree of transparency, including as to why transactions are rejected.

Furthermore, Adyen's visibility into the payments value chain allows the Company to gather data on shoppers' behaviors, which can then be used to generate actionable insights for merchants on how they can best serve their shoppers and optimize their systems and settings to achieve higher authorization levels.

Adyen mainly generates revenue from processing services (i.e., authorization, reconciliation, risk management, tokenization and payout services) and settlement services (i.e., underwriting settlement risk).

2. Business Analysis

Total Processed Volume

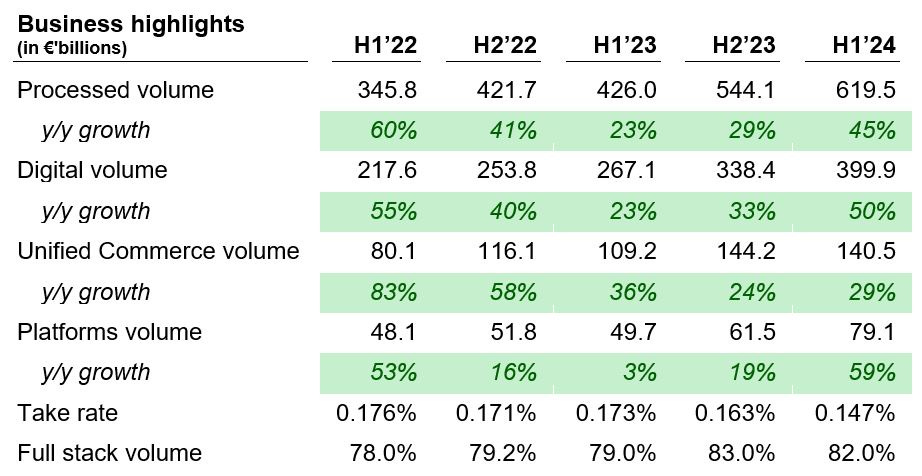

Given that Adyen takes a cut from processing payment volume, a key driver of the business is the amount of Adyen’s processed volume. The chart below shows how Adyen’s total processed volume has trended over time:

There’s been very strong growth over the past few years. Although there was a slight bump in growth in 2023, it was still double-digit growth, which management explained it was due to the price sensitivity in the competitive US market. Adyen stood their ground believing that their product provided more value, and total processed volume growth has bounced back strongly with 45% y/y in H1 2024.

On a related note, while the processed volume metric is not what Adyen runs the business on, there is underlying value in the information transactions contain. Adyen believes that their product offering strengthens as it scales, creating a network effect. This is because data enables technology to continually refine its ability to combat fraud, authenticate users, maximize successful payment completion, and improve customers total cost of ownership.

Further, in this period, Adyen’s global acquiring capabilities continues to grow, as they obtained additional licenses in India, and an acquiring registration in Mexico. As a reminder, Adyen does not outsource capabilities and functions, seeking to retain end-to-end control of the platform and remove third-party dependencies where possible. This takes long-term thinking, discipline and perseverance. This also explains why they have a huge amount of cash on their balance sheet – it’s easier to talk to regulators.

Take rate

Adyen’s take rate, defined as transaction revenue compared to transaction volume was 14.7 bps, down from 17.3 bps in H1 2023 and 16.3 bps in H2 2023. The decrease was driven primarily by merchant mix impacts. This is to be expected, as Adyen operates a tiered pricing model, where merchants get a discount for processing more volume. This is deliberate to gain market share, and it is why processed volumes and net revenue do not move in parallel.

Full-stack volumes

Full-stack volumes were 82% of processed volumes, up from 79% in H1 2023, aligning with the strategy of selling full-stack capabilities.

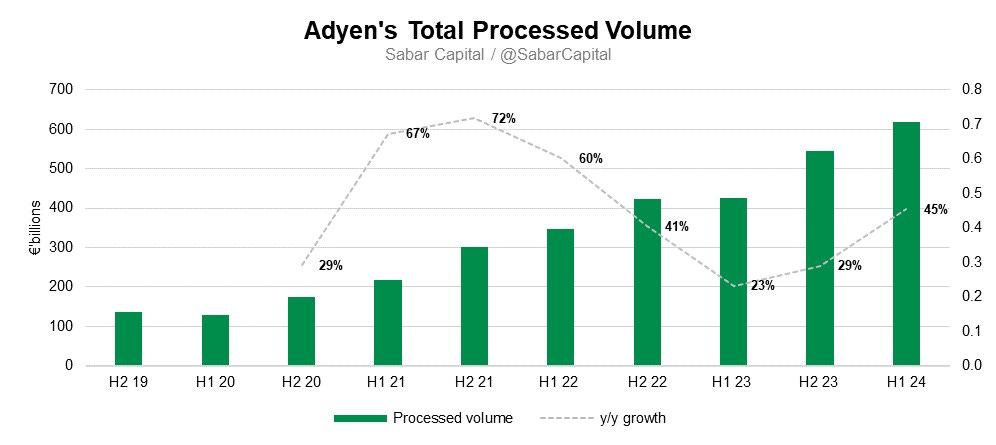

Adyen further splits total processed volume into three categories: Digital, Unified Commerce and Platforms.

Digital

Digital consists of processed volumes of non-platform merchants that process over 99.5% of their volumes online. Digitals volumes reached €399.9 billion, up 50% y/y, representing about 65% of total processed volume, making this the largest pillar. Adyen’s Digital volume growth was driven by, among other factors:

Solving for payment failures pertaining to subscription-model businesses

In subscription businesses, merchants face common problems relating to payment failures such as when a card expires or contains insufficient funds.

Adyen’s Real Time Account Updater ensures the cards are updated by continuously scanning for updated card details ranging from changes in expiration dates, card numbers, direct debit status, and even stolen notices.

Moreover, when a charge attempt is declined due to insufficient funds, Adyen’s systems would intelligently decide for an optimal retry time. An example cited was to attempt a date that affords time to refill, taking into account factors such as region and day of the month. In the case of the US, as most users are paid bi-weekly, typically on a Friday, Adyen managed to get an uplift in successful payments at the beginning and middle of each month.

Local Payment Methods (LPMs) – Importance of preferred payment methods

An increasingly important point for user conversion is ensuring that consumers are able to pay exactly as they want, and in the currency they want. Adyen’s recent Retail Report found that 55% of consumers abandon an online cart if they are unable to pay using their preferred method. This would differ across regions. For example, in North America, the UK and Australia, majority of the transactions are executed with credit cards. Austria and Netherlands, however, prefer bank payments. And for the developing countries in APAC where there’s a huge underbanked population, it’s likely that they will prefer non-bank forms of payments such as mobile wallets.

US debit capabilities – Optimizing for cheaper rates through alternative debit networks

What’s unique about the debit card industry in the US is that debit cards issued by major card schemes are required to be processed by two independent networks. This would drive up the costs of transactions due to premium interchange and scheme fees. Adyen helps merchants by using the multiple alternative debit networks available to optimize for cheaper conversion and rates.

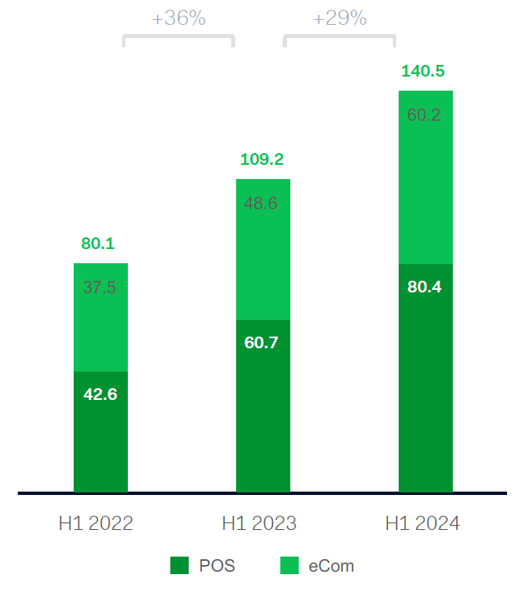

Unified commerce

Unified Commerce segment is the processed volume of non-platform merchants processing at least 0.5% of their volumes via point-of-sale. Unified Commerce volumes reached €140.5 billion, an increase of 29% y/y, with point-of-sale volumes up 32% y/y. This represents about 23% of total processed volume.

Autonomous stores

Adyen reported the interesting use case of autonomous shopping, where consumers can tap their card or mobile wallet at an Adyen payment terminal upon entry to pre-authorize upcoming spending. Think of taking an item of a shelf and walking out of the store – without the need to queue or check out.

Growing Unified Commerce customers

The number of Unified Commerce customers processing across channels at scale, being merchants processing at least €10 million on both POS and eCommerce, with over €50 million in total processed volume in the last 12 months, increased by 63, to 357 customers this period;

The number of Unified Commerce customers processing in multiple regions reached 540, up 79 y/y; and

The number of transacting Unified Commerce terminals reached 292,000, up 60,000 y/y.

Benefits of a consolidated touchpoint

Among the verticals, hospitality was the fastest growing, up 55% y/y. By consolidating all touchpoints in a single view, hotels are able to use real-time payment data to gain insights into where guests are coming from, their preferred method of payment, the spending amount or whether the trip is business or leisure. What this enables is for the hotel to be able to personalize offers or use cross-selling strategies, e.g., upgrading a room or providing transport.

Platforms

Platforms consists of processed volumes of customers processing at least 50% of their volumes via Adyen for Platforms. This pillar is mainly for software platforms (SaaS) and marketplaces. Platform users can sign up, sell, and get paid all in a single destination. Platforms handles the heavy lifting of onboarding users, contractors and businesses onto the platform, and even ensuring they are verified before conducting pay-out.

Platforms volume reached €79.1 billion, up 59% y/y. Excluding eBay volumes, Platforms volume growth would have been 91% y/y. It’s important to note that the super high growth rate is due to Platforms smaller size, representing only 13% of total processed volume.

It’s notable that the vertical which displayed the most growth was food and beverage.

Some highlights for Platforms:

The number of Platform business customers serviced reached 104,000 end-customers, up 55,000 y/y;

The number of transacting Platform terminals reached 165,000, up 79,000 y/y; and

The number of Platform customers processing over €1 billion reached 22, up 7 y/y.

Platforms is Adyen’s strategy to target the long tail of the market, being the SMEs. They believe that the adage that all companies will eventually become software companies requires slight tweaks; instead, they feel that every company will eventually run on an industry-specific software company. This is why Adyen has positioned Platforms early, essentially to capitalize on SMEs as traditional business models continue to digitalize.

3. Financial Analysis

Revenue

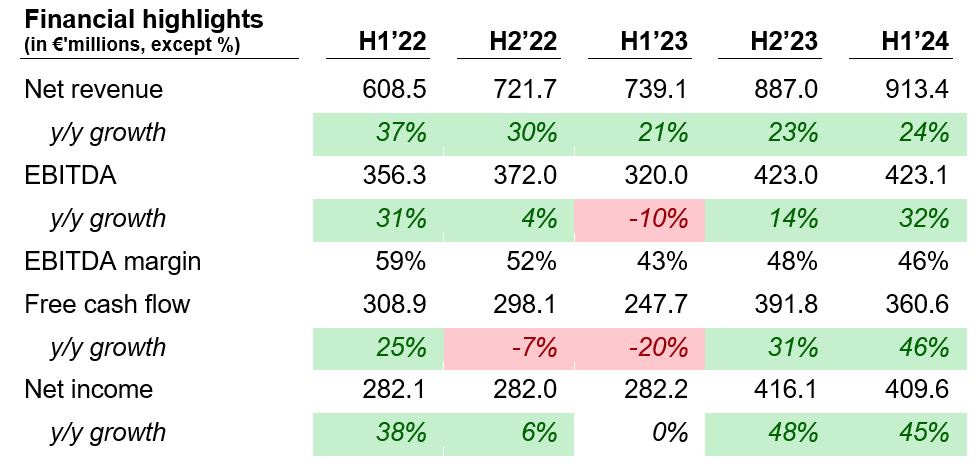

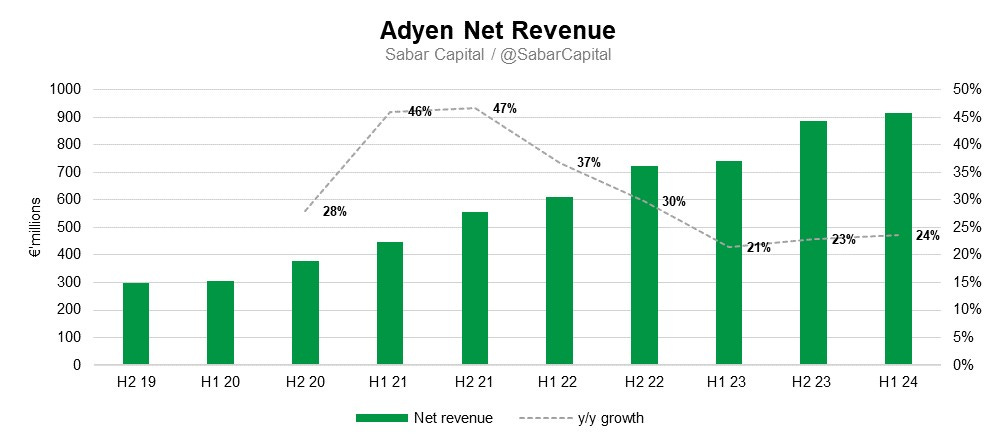

In H1 2024, Adyen’s net revenue was €913 million, representing a 24% y/y increase. The majority of growth was driven by growth with existing customers.

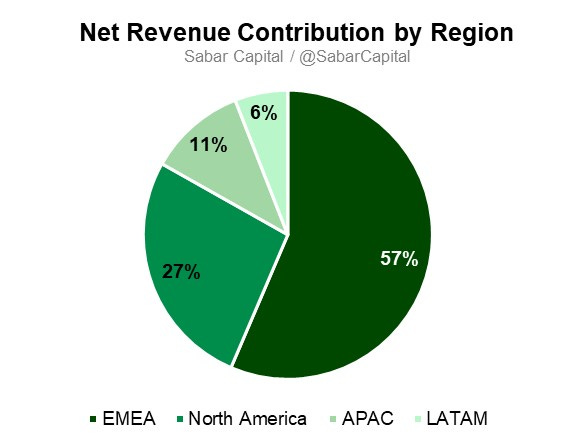

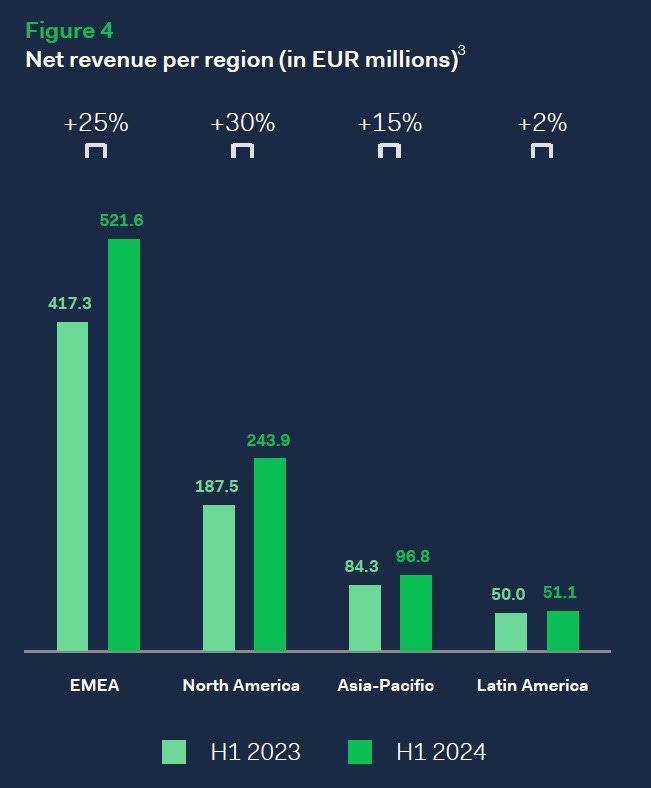

Net revenue contributions by region remained consistent y/y, as shown in the chart below.

North America was the fastest growing region (30%), followed by EMEA (25%), APAC (15%) and LATAM (2%).

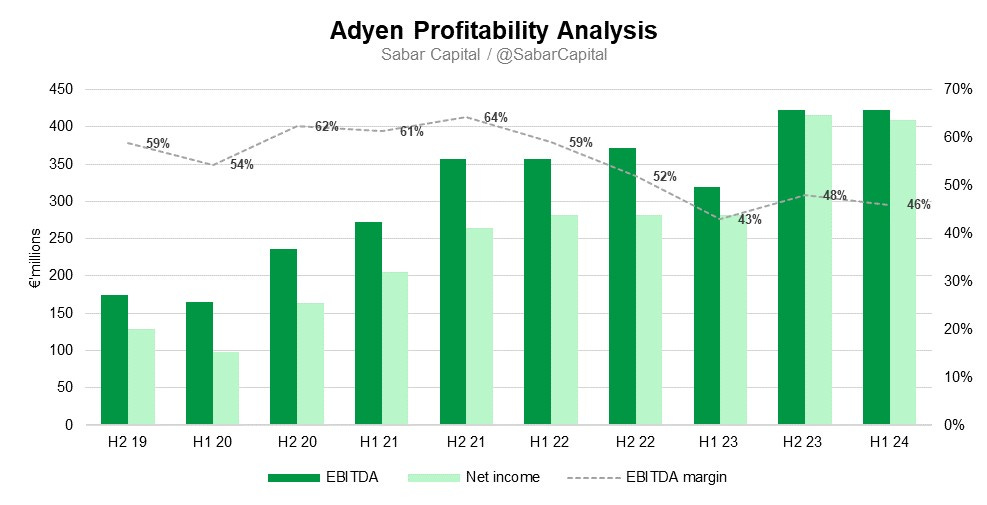

Profitability

In H1 2024, operating expenses were €538.3 million, up 19% y/y from H1 2023.

Employee benefits were €347.5 million, up 22% y/y, reflecting the annualization of hires made in 2023 and the continued scaling of the Adyen team.

IT costs reached €22.4 million, up 19% y/y mainly due to costs related to data centers and investment in IT related equipment.

Adyen continues to commit to pledging 1% of net revenue to initiatives that support the UN SDGs.

Adyen’s hiring slowed, as they hired 37 net-new joiners, reaching a total of 4,233 Full Time Equivalents (FTEs). The majority of the new hires this period were located in North America in tech and commercial roles.

As a result, EBITDA reached €423.1 million, up 32% y/y from €320 million. EBITDA margin increased from 43% in H1 2023 to 46% in H1 2024, with operating leverage becoming more visible, mainly due to this period’s cooled hiring pace as well as fewer one-off operational expenses.

Net income reached €409.6 million, up 45% y/y, primarily due to an increase in finance income driven by the relatively higher interest rate environment and an increase in average overnight deposits held banks and central banks.

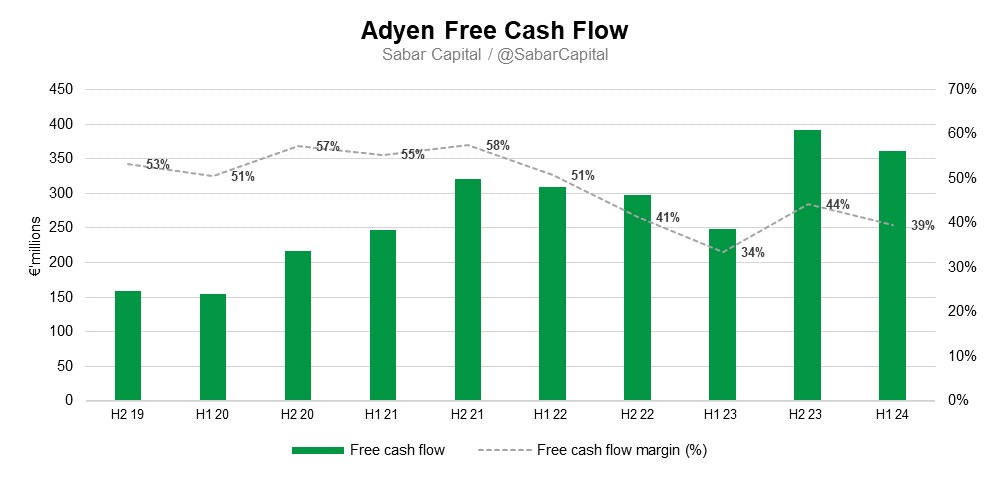

Cash Flow

Adyen delivered a free cash flow of €360.6 million, up 46% y/y.

Adyen’s capex was €42.3 million and 4.6% of net revenue, down from 7.6% in the previous comparable period, aligned with their capex policy of up to 5% of net revenue.

Balance Sheet

Adyen’s cash and cash equivalents reached €8.7 billion in H1 2024. After deducting the payables to merchants and financial institutions of €6 billion, Adyen’s net cash balance is about €2.7 billion, with no debt. A rock-solid balance sheet.

4. Earnings Call Highlights

New hires expected to contribute to net revenue growth but will take time

It will take some time for that hiring to be visible in our net revenues. So it's too early to say that it's already a big impact in the first half, but the early signs are good.

We see that the new hires are able to build pipeline and able to move that pipeline through the various phases of the sales cycle. So we do see good early signs of progress and expect that it will contribute to our growth over the coming years.

Adyen’s US debit capabilities is unmatched by the competition

Yes, on U.S. debit, the way how we build U.S. debit is to optimize at the one hand, for low-cost routing, and on the other hand, also for the highest authorization rates. And I think that functionality, the way how we've implemented it is unique.

I don't think that our competitors do that in the same way that we can do it, and that's also why we are very well positioned to work with our customers and offer it. We are continuously upgrading those connections because indeed these are multiple networks. And there's certainly some work to be done to get to the last stage where we want to be to have the optimal experience, but we already have a very strong offering for U.S. debit.

Adyen plans to hire more in H2 2024, but it’s not expected to have a significant impact on EBITDA margins

So in terms of the hiring, yes, we do plan to hire more in the second half. But in the scheme of things, it's still a relatively small number, compared to the overall team that we've built over the years. So I don't expect it to have a major shift on impact between H1 and H2, especially because EBITDA margin progression is typically seen on a 12-month rolling basis.

LATAM’s growth should improve longer-term given the investments made in acquiring in Mexico and Brazil

So I think, first of all, the places where we have offices, also, they help to sell into different regions. So the way how we recognize revenues. So revenues in Lat Am is indeed the revenues that we process locally in Lat Am, but for instance, Lat Am also sells into other regions, and that's not being reflected in that number.

So the offices are very successful. The fact that you see less of growth in Lat Am as an example is because we are -- continue to improve our connections there. So we have our own acquiring now in both Mexico and Brazil. That also means that we can further improve our products. So for instance, with anticipations, which is a key feature in the Brazilian market, we have been in a position now to make changes there, and we become more in a better competitive position. So for the long term, we are in a really good position, and I expect going forward that our growth rates also in Lat Am will further increase.

Strategy is on organic growth, rather than M&As

So we've always had an organic growth strategy. And the reason for this is that we strongly believe that building the infrastructure ourselves gives us full control. And the moment you would start to consolidate platforms, you always end up with a question like which platform are we going to terminate, how are we going to migrate customers. I think there are a lot of examples in this industry where that has been very painful or just not working.

Customers select us because of our performance and the fact that we have this full control. At the same time, we're never dogmatic, but for us, focusing on executing on our strategy, the things that we have already built, that is key to being successful. So I don't expect any change in our strategy so far.

Biggest parts of the non-full stack volumes are airlines, American Express and PayPal

As we shared in the past, our non-full stack volume today is mostly in industries where you weren't looking to do the acquiring in the past, like airlines, for example, or with certain payment methods. The biggest ones that come to mind are American Express and PayPal, where there's the option to do that as gateway volume.

Those still remain the biggest parts of the non-full stack volume. So it's not that we are employing some specific strategy around it. We've brought on most of the acquiring volumes on our own licenses over the years in the markets where we operate.

5. Takeaway

Processed volume growth remains strong across Digital, Unified Commerce and Platforms. The competitive advantage that Adyen has continues to show its strength by Adyen winning market share. And still, there’s room to grow. Even in their more mature markets of EMEA and North America, they only have single-digit market share. Adyen continues to invest to reduce the total cost of ownership for merchants through various ways. As the company ends their accelerated hiring phase, the benefits of that should become clear in the coming years, as the company targets EBITDA expansion to 50% or more by 2026. With an excellent balance sheet with no debt, Adyen remains a compounder for the long-term.

Disclaimer: Please note that none of the information provided constitutes financial, investment, or other professional advice. It is only intended for educational purposes. We have a vested interest in Adyen. Holdings are subject to change at any time.