Company Snapshot: dLocal Ltd (NASDAQ: DLO)

Unlocking Emerging Market Payments for Global Businesses

Hi guys,

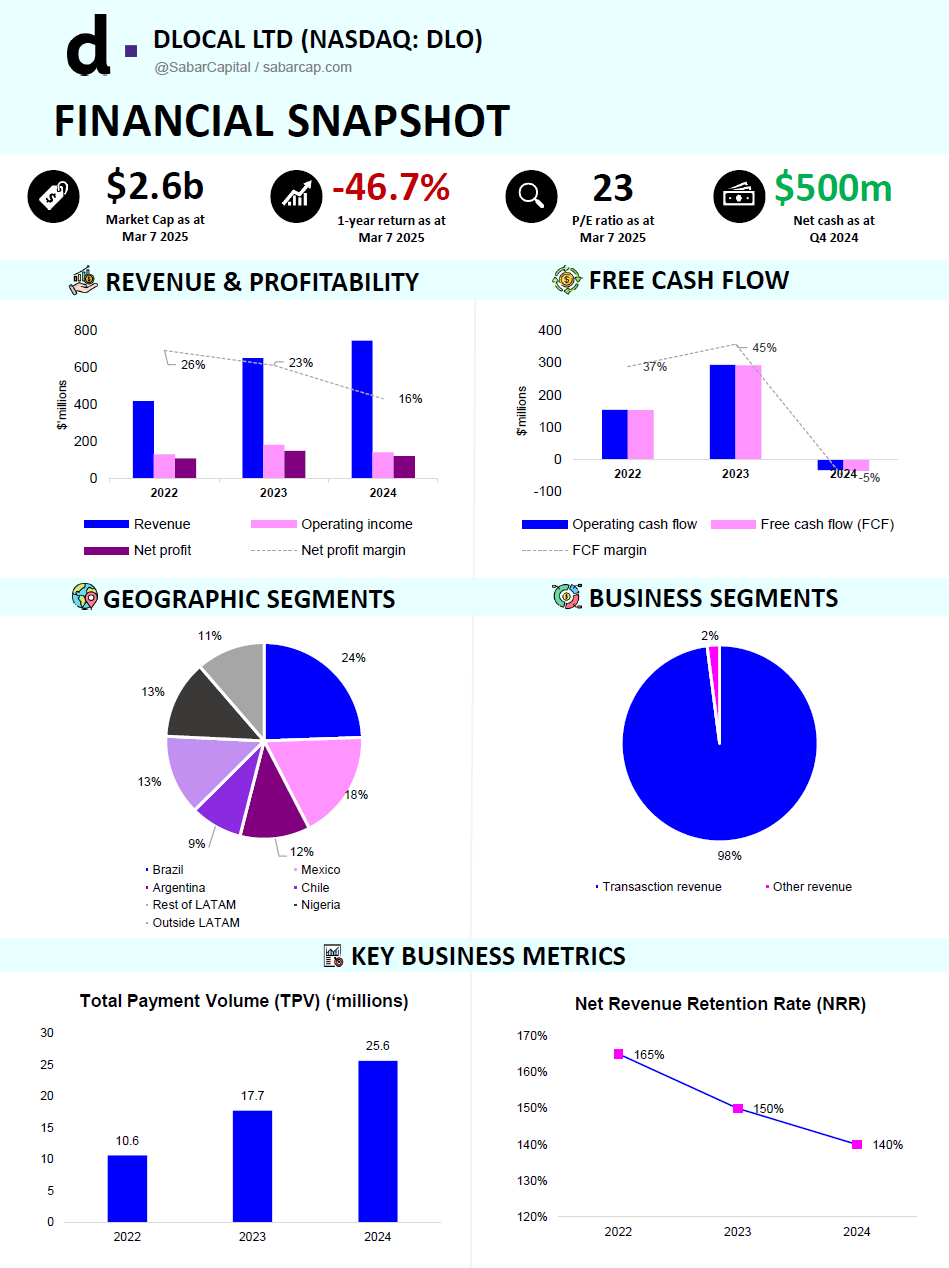

This week’s company is dLocal Ltd (NASDAQ: DLO), a ~$2b market cap payment processor that’s focused on handling payments for global enterprise merchants in emerging markets. This is a fairly young company, having IPO-ed on the NASDAQ in 2021. Considered to be one of the “pandemic darlings”, its stock price fell from a high of $69 in 2021 to around ~$9 today, while revenues grew approximately 3x. I hope you enjoy!

My idea of the Company Snapshot series is to offer a quick dive into a business, highlighting what makes them special. Rather than a lengthy deep dive, this format focuses on a high level overview, providing readers with digestible insights. Each Company Snapshot will follow this structure:

Business Overview

Competitive Landscape

Key Financials

Opportunities

Risks

Business Overview

Founded in 2016 and headquartered in Montevideo, Uruguay, dLocal provides a payments platform designed for global enterprise merchants operating in emerging markets. Through a single API, platform, and contract — known as the One dLocal model — the company enables businesses to seamlessly receive payments (pay-ins) and make payouts (pay-outs) worldwide. Here’s some examples of how it works:

Pay-in: A US-based merchant receiving payments from a customer in Brazil. The merchant could be receiving the funds in the US (cross border) or to their Brazilian entity (local-to-local).

Pay-out: The same merchant paying suppliers or logistics providers in Brazil. Similarly, the merchant could be paying the suppliers from the US (cross border), or from their Brazilian entity (local-to-local).

Platform: A ride-sharing or e-commerce platform collecting payments from customers while paying drivers or sellers.

dLocal's fully cloud-based platform supports cross-border and local transactions in 40 countries (as of end 2023) and connects merchants to 900+ local payment methods across financial institutions and emerging markets. dLocal works with 600+ enterprise merchants, including: Microsoft, Spotify, Salesforce, Deel, Wish, Expedia, Shein, Tencent, Telegram, Bolt, Rappi, PedidosYa. On average, global enterprise merchants utilizing dLocal's platform operate in eight different countries and leverage 70+ payment methods. The company serves a wide range of industries, including e-commerce, SaaS, financial services, streaming, ride-hailing, gaming, crypto, travel, and on-demand delivery.

As global businesses expand into emerging markets, they face unique payment challenges, seeking to partner with processors with high acceptance and conversion rates for local cards and alternative payment methods (APMs), FX management and compliance with local regulations, and fraud and tax management across different geographies. Unlike traditional payment providers focused on developed markets, dLocal offers deep local expertise to help merchants navigate complex payment infrastructures.

Beyond payment processing, dLocal is also expanding into value added services. The company's latest product, dLocal for Platforms, streamlines onboarding, verification, and global payments for marketplaces and multi-sided platforms. By optimizing funds management, cash flow, and customer experience, this solution helps platforms reduce costs and scale efficiently.

The company makes money by charging fees to merchants for processing cross-border and local payments in emerging markets. These fees are typically based on a fixed fee per transaction, or a percentage of the transaction amount. The other types of fees charged are as follows:

Processing fees: Standard charges for handling transactions.

FX service fees: Earned when payments involve currency conversion and fund transfers (e.g., converting local currencies to USD or EUR).

Installment fees: For transactions that allow customers to pay in installments.

Chargeback & refund fees: Applied when transactions are disputed or reversed.

Other minor fees:

Setup fees for onboarding new merchants.

Monthly maintenance fees for account management.

Small transfer fees for low-value transactions.

While dLocal operates in developed economies such as the United States, Europe, and China, its revenue is primarily derived from emerging markets, where it enables global merchants to accept payments and make payouts. Its revenue is largely driven by key regions such as Brazil (24%), Mexico (18%), Nigeria (13%), Argentina (12%), and Chile (9%). In January 2025, dLocal expanded its operations into the United Kingdom by acquiring an Authorized Payment Institution (API) license from the UK Financial Conduct Authority (FCA), strengthening its presence in the European market.

Competitive Landscape

Single API improves performance

dLocal’s single API streamlines global payment processing, offering multiple advantages for merchants:

Pricing transparency

Easier reconciliation & refunds

Seamless expansion as merchants can quickly add local payment methods in new markets

More reliable system availability with reduced downtime and transaction failures

Higher conversion rates with features like automatic retries and fallback transactions

Lower fraud & compliance risks from built-in security and local expertise reduce regulatory issues.

Direct connections with merchants

Large enterprise merchants go through rigorous vetting when selecting a payments provider, often taking months to onboard due to security, compliance, and regulatory checks. However, once integrated, these merchants gain instant access to dLocal’s full payment network across emerging markets — without the need for additional contracts or integrations.

By establishing direct connections with merchants instead of relying on third-party intermediaries, dLocal secures long-term relationships, making it difficult for competitors to displace. Merchants can choose to process all or part of their payment flows through dLocal, reinforcing its role as a strategic payment partner.

While the payment space is competitive, dLocal has carved out a unique niche. Unlike global players like Stripe or Adyen, which prioritize developed markets first and expand later, dLocal specializes in helping enterprise merchants from the U.S., Europe, and China navigate payments in emerging economies like Latin America, Africa, and Asia.

These regions pose significant challenges, including high payment fragmentation, complex regulations, and limited financial infrastructure. dLocal’s deep expertise in local tax, compliance, and FX management allows global merchants to expand seamlessly while overcoming regulatory hurdles.

Key Financials

Opportunities

Increasing digital commerce and payments

Emerging markets in LATAM, Africa and Asia are seeing rising e-commerce adoption

Consumers are shifting to cashless payments

Expansion into new markets

Recent UK license supports the expansion for UK-based merchants

While dLocal already has a strong presence in LATAM, they are expanding into Africa and Asia

85% of the world’s population resides in emerging markets, 2/3 of global growth by 2035 will come from there

Innovation pipeline for value-added services, which would increase retention and gain more share of wallet

New growth vectors like stable coins

New products and innovation

Risks

*Update: A new risk, "Potential Integrity Issues" has been added; thanks to Heavy Moat Investments for pointing this out.Potential integrity issues*

In 2022, Muddy Waters released a short report on dLocal, alleging conflicting disclosures, accounting issues, and the skepticism of their take rates relating to their margins from partnering with other acquirers and FX gains, and corporate governance deficiencies.

dLocal was spun off from AstroPay, a payment processing service that operates mainly in Brazil, Latin America and India and is focused on industries such as online gambling, forex trading and adult entertainment. These industries are legally considered to be in a grey area, and even illegal in certain jurisdictions. While there was a change in management, currently, there are at least two directors that are also major shareholders of AstroPay: Andres Bzurovski Bay and Sergio Enrique Fogel Kaplan. Bay and Kaplan both hold a combined ownership of ~36.76% of dLocal.

Competition

Global payment processors like Stripe and Adyen are expanding in emerging markets, where dLocal could lose market share if they don’t keep prices competitive or provide sufficient value to merchants over the competition

Customer concentration risk

dLocal generates a significant portion of its revenue from a few large merchants

In 2023, dLocal’s top 10 customers represented 60% of revenues

FX risks

Many LATAM countries have volatile FX, which can significantly impact dLocal’s profitability

Conclusion

dLocal offers a compelling solution for global enterprise merchants expanding into emerging markets, a region expected to drive long-term global growth. By focusing on this niche, dLocal helps merchants navigate payment complexities, simplifying market entry. However, competition in this space is heating up. In order for dLocal to compete with global payment processors like Stripe and Adyen, dLocal needs to compete on the value it delivers. Value can be defined as the net benefits derived from their services and problem solving capabilities relative to its pricing.

One key distinction between dLocal and a competitor like Adyen, lies in their operating models. While Adyen is a full-stack payments processor, controlling the entire payment chain, dLocal acts more as an aggregator, partnering with local processors and acquirers. This means Adyen has greater end-to-end control and visibility, while dLocal leverages local expertise and infrastructure. Competing effectively would require dLocal to differentiate not just through its reach but through the depth of its services, merchant support, and ability to drive conversion rates in complex emerging markets.

Disclaimer: Please note that none of the information provided constitutes financial, investment, or other professional advice. It is only intended for educational purposes.

*Update: I've added a new risk, "Potential Integrity Issues" — thanks to @HeavyMoatInvestments for pointing this out.

I linked to your post in my Monday emerging market links collection post: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-march-17-2025

For what its worth, the Muddy Waters short report is from Nov 2022: https://muddywatersresearch.com/research/dlo/mw-is-short-dlo/