Company Snapshot: DoorDash, Inc. (NASDAQ: DASH)

A Platform Built with Merchants at Its Heart

Hi guys,

This week’s company is DoorDash, Inc. (NASDAQ: DASH), the ~$76b market cap company that delivers food to your doorstep. DoorDash is particularly interesting because they managed to outcompete its rivals to become the king of food delivery in the second largest market in the world, the United States of America. Enjoy!

My idea of the Company Snapshot series is to offer a quick dive into a business, highlighting what makes them special. Rather than a lengthy deep dive, this format focuses on a high level overview, providing readers with digestible insights. Each Company Snapshot will follow this structure:

Business Overview

Competitive Landscape

Key Financials

Opportunities

Risks

Business Overview

Founded in 2013, DoorDash operates a logistics platform that connects merchants, consumers and dashers. The company’s offerings include the DoorDash Marketplace, Wolt Marketplace and Commerce Platform. Their marketplaces operate in over 30 countries globally and provide an integrated suite of services that help merchants establish an online presence, connect with consumers in their communities, and solve mission-critical challenges, such as customer acquisition, demand generation, order fulfilment, merchandising, payment processing, and customer support.

DoorDash typically earns a fee from merchants for the services provided based on the size of each transaction. The company also offers advertising as a value-added service through their marketplaces to help merchants and consumer packaged goods companies increase consumer engagement and drive incremental revenue.

Their marketplaces compete for consumers based primarily on the selection, convenience, quality, affordability and service provided. DoorDash typically charge consumer fees for each transaction, inclusive of a fixed delivery fee and a service fee that varies based on the size of the transaction. Further, the company offers consumer membership programs, DashPass and Wolt+, which aim to lower transactional friction by reducing the delivery and service fees charged, while providing additional membership benefits. At the end of 2024, the marketplaces served over 42 million monthly active users, and had over 22 million DashPass and Wolt+ members.

The Commerce Platform is a suite of services that help merchants grow, run, and operate their businesses on their own channels. DoorDash Drive On-Demand and Wolt Drive are white-label delivery fulfillment services that generate the majority of revenue within the Commerce Platform. Additionally, the company also provides services that help merchants establish online ordering, build branded mobile apps, and enable tableside order and pay, and improve customer support.

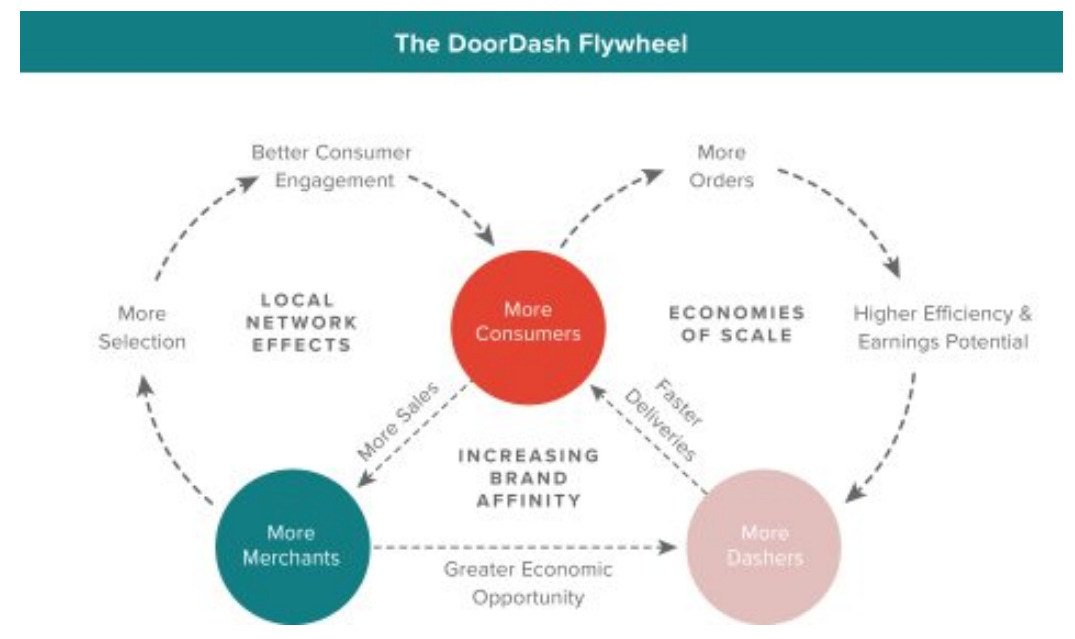

The following diagram shows the DoorDash flywheel taken from their S1 filing, which is typical of a food delivery business: more consumers means more merchants, which leads to more Dashers, increasing the efficiency and speed of deliveries, causing more orders from consumers.

Competitive Landscape

The competitive landscape for the food delivery market is highly competitive and fragmented. Given that majority of DoorDash’s revenue comes from the US (~88%), it’s main competitors are Uber Eats and Grubhub. Here’s a chart showing how the food delivery market share trended in the US from 2016 to 2023:

DoorDash had a meteoric rise over that time period, growing from under 10% in 2016 to approximately 67% of market share in the US in 2023, the second largest market for food delivery behind China. It should be noted that this growth wasn’t all organic though, as DoorDash acquired Caviar from Square for $410 million in August 2019. Caviar was a premium food delivery service known for partnering with upscale restaurants and operating in select metro areas like New York City, Los Angeles and San Francisco. This is particularly interesting because Uber Eats seems to have struggled to grow market share despite acquiring Postmates (yellow line) in 2020.

Perhaps part of the reason for DoorDash’s success, aside from their execution, could be due to their suburban focus. The company has strategically focused on suburban markets and smaller metropolitan areas early on, which they believe has given them a competitive advantage as these markets were historically underserved.

The other aspect could be its merchant-first approach. DoorDash focuses on being inclusive to all types of merchants, regardless of their scale, business model or location. Their platform is designed to integrate seamlessly with merchants existing processes and workflows. This also means DoorDash integrates into existing workflows through which merchants receive their orders, including website, email, tablet, phone and even fax through the use of direct API integrations, middleware platforms and hardware/software solutions. Beyond POS integrations, the company also provides merchants features such as payment processing, customer support, data analytics such as menu optimization insights, and their white-label delivery service, via DoorDash Drive, which essentially enables merchants to use DoorDash’s logistics while keeping their own branding and customer relationships.

Key Financials

Opportunities

Continued expansion into verticals beyond food such as grocery, convenience store, pharmacy and pet supplies. DoorDash has moved to expand into non-food verticals to take advantage of their logistics network and expand their total addressable market (TAM).

International growth. DoorDash operates in over 30 countries along with its Wolt brand in countries such as Australia, Canada, Germany, Israel and Finland. Growing market share in existing countries and expanding into new countries would greatly expand their TAM.

Risks

Intense competition: The food delivery market is highly competitive and can be disrupted by shifting user preferences and frequent introduction of new services. Increased competition could lead to pricing pressure which could affect profitability. New entrants could potentially grab market share especially if DoorDash slacks, but that doesn’t appear to be the case given DoorDash’s continued market share growth in the US.

Retention and acquisition of merchants, consumers and dashers: In order to retain the three constituents, DoorDash has to ensure that using their platform is advantageous to each of them, as failure to do so would cause the constituents to switch to another platform offering better options

Conclusion

Since its listing in 2020, DoorDash has shown strong growth and has turned profitable in 2024. The company’s focus on merchants and managing their three constituents (merchants, consumers and dashers) are bearing fruit. Their business only gets stronger as they scale. The company’s valuation seems quite rich at a P/S of 6.5, and the company has only turned a profit in 2024. Time will tell if they manage to maintain their leadership, but for now they are in an enviable position, dominating the US food delivery market.

Disclaimer: Please note that none of the information provided constitutes financial, investment, or other professional advice. It is only intended for educational purposes.