Costco: Driving Growth Through Value

Costco (COST) Q4 2024 Earnings Analysis

Table of Contents

About Costco

Business Analysis

Financial Analysis

Earnings Call Highlights

Takeaway

1. About Costco

Costco operates membership warehouses and e-commerce websites based on the concept that offering members low prices on a limited selection (~4,000 SKUs) of nationally-branded and private-label products in a wide range of categories will produce high sales volumes and rapid inventory turnover. When combined with the operating efficiencies achieved by volume purchasing, efficient distribution, and reduced handling of merchandise in no-frills, self-service warehouse facilities, these volumes and turnovers enable us to operate profitably at significantly lower gross margins than most other retailers.

Costco buys most of their merchandise directly from suppliers and routes it to depots or directly to their warehouses, creating freight volume and handling efficiencies, lowering costs associated with multi-step distribution channels.

The warehouses are designed in for economy and efficiency in the use of selling space, handling of merchandise and control of inventory. For example, merchandise is generally stored on racks above the sales floor, or displayed on pallets containing large quantities. Many consumable products are offered for sale in case, carton or multiple-pack quantities only. Moreover, by strictly controlling the entrances and exits with a membership format, Costco’s inventory losses, or shrinkage, are well below the industry average.

Costco’s merchandise and services are in the following categories:

Core Merchandise Categories (or core business):

Foods and Sundries (including sundries, dry grocery, candy, cooler, freezer, deli, liquor, and tobacco)

Non-Foods (including major appliances, electronics, health and beauty aids, hardware, garden and patio, sporting goods, tires, toys and seasonal, office supplies, automotive care, postage, tickets, apparel, small appliances, furniture, domestics, housewares, special order kiosk, and jewelry)

Fresh Foods (including meat, produce, service deli, and bakery)

Warehouse Ancillary:

Gasoline, pharmacy, optical, food court, hearing aids, and tire installation

Other Businesses:

E-commerce, business centers, travel, and other

Costco is widely known for maintaining an average markup of 14-15% on its products, which keeps prices competitive and results in operating near breakeven or with minimal profit margins. Instead, most of Costco’s profits come from its annual membership fees.

2. Business Analysis

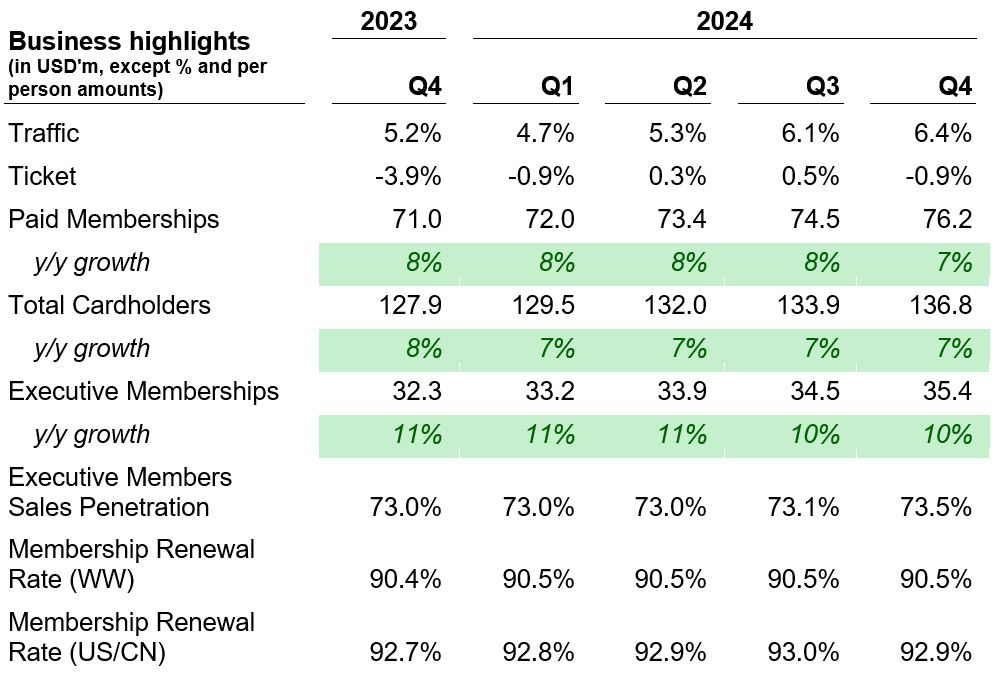

Traffic and Ticket

Traffic, or shopping frequency, increased 6.4% worldwide in Q4. This was driven by traffic increase of 5.6% in the US, 7.7% in Canada and 8.1% Other International.

Ticket, or average transaction size, decreased 0.9% worldwide. Ticket decreased by 0.3% in the US, 2.1% in Canada and 2.2% Other International. These include headwinds from gas deflation and foreign exchange. Adjusted for those items, ticket would be 0.5% worldwide and 0.6% in the US.

Membership

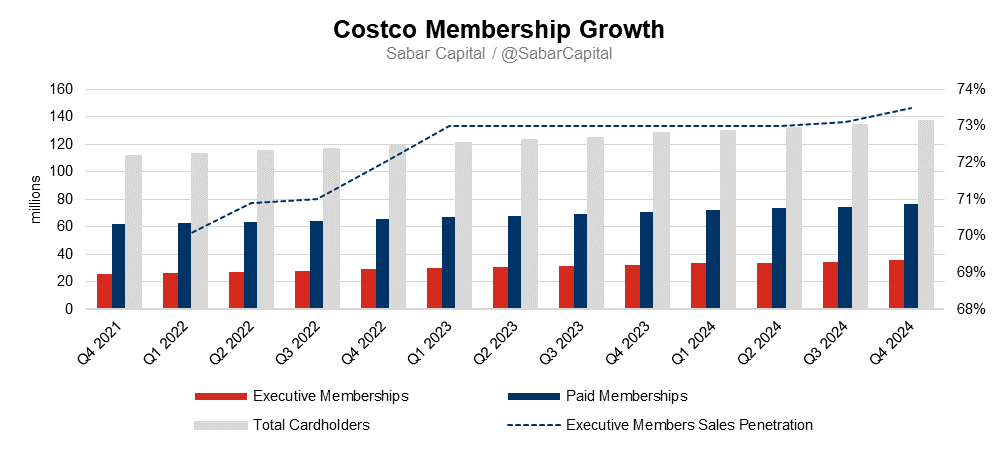

Paid Membership

Costco ended Q4 with 76.2 million paid household members, up 7.3% y/y and 136.8 million cardholders, up 7% y/y. Costco estimated about half of new member sign-ups in the year were under 40 years of age. This cohort has been growing since COVID and has lowered the average age of their members over the last few years. Costco members’ average is about 35-44 years.

Executive Membership

Executive Memberships are generally for members that are bigger spenders and are more frequent Costco shoppers. It’s priced at $130 annually, twice the amount of the normal membership fee of $65. However, Executive Members can earn a 2% reward based on their spending, capped at $1,000 annually, as well as other benefits.

Costco reached 35.4 million paid executive memberships, up 9.6% y/y. Executive members represent 46.5% of paid members, but 73.5% of worldwide sales.

Membership Renewal Rate

Membership renewal rates in US and Canada fell slightly to 92.9%, from 93.0% in the previous quarter. This was due to an online membership promotion that was run in 2023 which resulted in 200,000 new sign-ups. Digital promotions typically have lower renewal rates, and as those members entered the renewal rate calculation for Q4 2024, it had a negative impact on the overall renewal rate.

Membership renewal rates worldwide were 90.5%, unchanged from the previous quarter, with improvements in International offsetting the slightly negative in US and Canada.

Warehouses

Costco opened 14 new warehouses in Q4: 10 in the US, 2 in Japan, and one each in Korea and China. For the fiscal year 2024, Costco hit their target of 30 new warehouse openings, including one relocation, resulting in 29 net new warehouses.

For fiscal year 2025, Costco targets 12 of their planned 29 openings to be outside of the US. With three warehouses being relocations, Costco expects 26 net new buildings for the upcoming fiscal year.

3. Financial Analysis

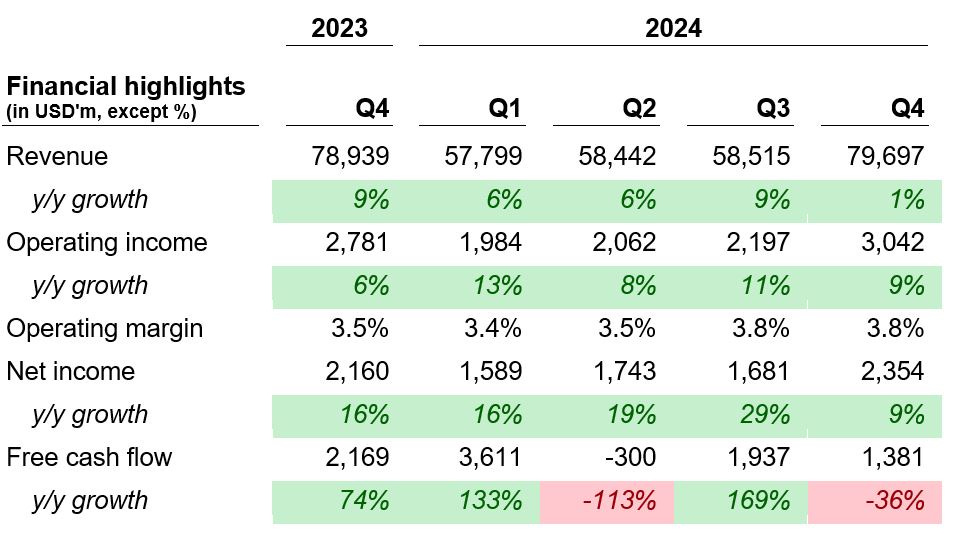

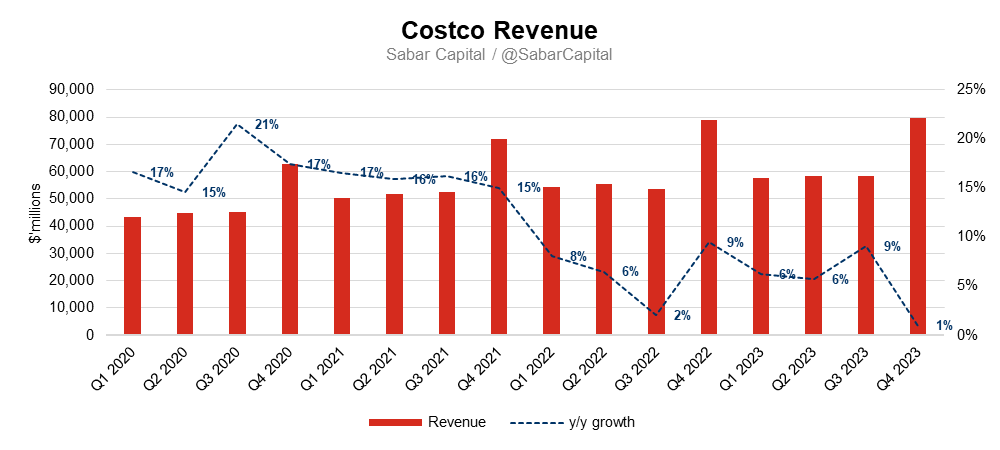

Revenue

Costco delivered revenue of $79.7 billion in Q4, up 1% y/y.

Net sales for the quarter reached $78.2 billion, up 1% y/y. Adjusting for the extra week last year though, net sales would be up 7.3% y/y.

US comparable sales were up 5.3% or 6.3% excluding gas deflation. Canada comparable sales were up 5.7% or 9.3% excluding gas deflation and foreign exchange. Other International were up 5.7% or 9.3% adjusted. On a total company comparable sales basis, Costco grew 5.4% or 6.9% adjusted.

E-commerce sales were up 18.9% y/y or 19.5% y/y adjusted for foreign exchange

Membership fee income was $1.512 billion, representing a 0.2% increase y/y or an increase of $3 million. Adjusting for the extra week last year and foreign exchange, membership fee income was up 7.4%.

Profitability

Costco gross margin was higher y/y by 40bps, at 11.0% compared to 10.6% last year, and up 33bps excluding gas deflation.

Core was lower by 5bps and lower by 11bps excluding gas deflation.

Ancillary and other businesses was higher 44bps and 42bps excluding gas deflation. The increase was driven by gas and e-commerce. E-commerce benefited from strong sales growth, item mix and fulfilment productivity. Gas margins benefited from moderate tailwinds and lapping a slightly weaker quarter last year.

2% rewards was higher by 4bps or 3bps excluding gas deflation, indicating higher sales penetration from executive members.

LIFO was up by 5bps, with an $8 million LIFO credit in this quarter, compared to a $30 million charge last year.

SG&A was higher y/y by 8bps, coming in at 9.04% compared to last year’s 8.96%, and 2bps adjusted for gas deflation.

Operations component of SG&A was higher by 4bps, but flat excluding gas deflation. Higher wages went into effect for the last 6 weeks of the quarter in US and Canada, which was a headwind of approximately 4bps.

Central was higher by 3bps and 2bps without gas deflation. Stock compensation was flat y/y and preopening was higher 1bps but flat excluding gas deflation.

Operating income reached $3.0 billion, up 9% y/y. Net income was up 9% y/y, and excluding this year’s nonrecurring tax benefit and normalized for the extra week, net income was up 12.7%.

Cash Flow

Costco delivered a free cash flow of $1.38 billion, down 36% y/y. On a full 2024 fiscal year basis, was down by 1.7% from $6.75 billion in 2023 to $6.63 billion in 2024.

Balance Sheet

Costco’s cash position including short-term investments was $11.14 billion and total debt was $8.27 billion, resulting in a net cash position of $2.87 billion at the end of the quarter. An excellent balance sheet.

4. Earnings Call Highlights

Costco app is picking up traction

…Members are very excited about being able to check warehouse inventory via the Costco app….

…Our app was downloaded 3.5 million times in the quarter, bringing total downloads to approximately 39 million, and we recently upgraded the native search function on our U.S. mobile app, leading to a doubling of the click-through rate on search results.

Membership card scanners are increasing member sign-ups and member renewals

…And the membership card scanners installed at the front doors have delivered on the goal of speeding up the checkout process….

…We have seen some lift in member sign-ups from that. We've also seen a lift in renewals because before people get to the front end, now they're aware that my renewal is going to be due when I get to the registers, so members are very appreciative about that. They know that and they get up to the front, and they're not shocked by that process as well.

So improved productivity, improved interaction. And as we know, as our volumes grow, we're looking for everything we can find to use technology to help get our members through the front ends in a good, smooth manner….

…The purpose of the card readers at the front door, this is a system we've been using for over 2 years now in Europe and especially in the U.K. and we've piloted here in the U.S. for about 6 months. Several different benefits for it. It gives our operators real-time traffic counts throughout the day. So we're able to adjust front-end lines that we need to open and close lines based on the fluctuations of business. We can monitor our fresh foods a little better because we know what the traffic counts look like and so forth.

And it has also taken the friction of membership verification away from the front-end registers and move that to the front door, where we're able to look at people's membership status. We let them know if their renewals is due before they get to the front end. So we've realized some very nice, healthy front-end improvements in productivity, and it's allowed our operators to manage the business much better throughout the day….

Non-foods drove sales this quarter

…nonfoods led the way with the highest comparable sales in Q4. Our buyers have done a fantastic job finding new and exciting items at great values. Gold and jewelry, gift cards, toys and seasonal, home furnishings, tires and housewares, all were up double digits in the quarter. Health and beauty aids also performed well as we have expanded and elevated that category with new high-end SKUs, both online and in warehouse, including assorted luxury fragrances at a 30% to 70% value to retail.

Continued focus giving value to the customer

…Across the fresh departments, we saw high single-digit growth as our continued focus on value is resonating with our members. An example of this in the meat department is our Kirkland Signature Boneless Chicken Tenderloins, where we lowered the price 13% and saw a 21% lift in pounds sold….

… Our goal is always to be the first to lower prices where we see the opportunities to do so. And just a few examples this quarter include KS Standard Foil reduced from $31.99 to $29.99. KS Macadamia Nuts reduced from $18.99 to $13.99. KS Spanish Olive Oil 3-liter reduced from $38.99 to $34.99 and KS Baguette, 2-pack reduced from $5.99 to $4.99….

Costco is in the process of transitioning to locally produce SKUs in other Asian markets

We've also found success working with suppliers to localize production of bulky items such as water, paper and laundry detergents. By manufacturing these goods closer to the countries in which they're sold, both costs and emissions associated with the shipment of these goods are greatly reduced. This quarter, we introduced our new Japan-produced Kirkland Signature Paper Towels. In addition to the emissions benefits from no longer shipping millions of units of paper towels from the U.S. to Asia, the reduced freight allowed us to lower the price by approximately 30% or $8 per unit in that market.

As production ramps up, we are in the process of transitioning our other Asian markets to locally produce SKUs. Shifting the production country of this one product will result in annual member savings of $30 million.

The launch of Buy online and pick up for TVs in the US

The rollout of buy online and pickup in warehouse for TVs in the U.S. market was also completed in Q4. This allows same-day pickup of a new TV for members who prefer not to wait for delivery.

Costco Next continues to grow

Costco Next, our curated marketplace, while still small, continued to grow nicely in the quarter. We added 11 new vendors, bringing the total to 86 and adjusting for the extra week, gross sales grew nearly 40% year-over-year.

The positive impact of the membership fee increase will be only be apparent in the second half of fiscal year 2025

A brief comment on the membership fee increase that went into effect on September 1.

Due to deferred accounting, this will have minimal impact early in the year. The vast majority of the benefit will come in the back half of fiscal year 2025 and into fiscal year 2026.

Kirkland Signature should create a tailwind to overall margin as it continues to grow

…We continue to see the penetration grow. And it's in the high 20s now as it continues to grow as our penetration across the board goes….

…Obviously, we stay very disciplined about -- we have a cap on the margin that we expect to make on a Kirkland Signature product. But as that mix continues to grow, it definitely creates some overall tailwind in our margin overall. And I mentioned a couple of examples in the prepared comments. We're also seeing some really great opportunities as we're thinking more globally across our merchandising team is really working together and finding ways to buy more efficiently and in-country production that we mentioned…

Trends on member shopping patterns

…I think the encouraging thing for us is, as you know, as you look at our trends in the year-to-date, we have seen that as inflation has dissipated, our members have started to spend more on nonfood items, which is really encouraging in our mind….

…On the food side of things, we've definitely seen some signals that would suggest that members and consumers in general are maybe shifting a little bit of spend from food away from home to food at home. Under the food and the sundry side of our business, alcohol would still be relatively soft. But as I mentioned in my prepared remarks, we're seeing really strong growth in our ethnic food categories and also in Kirkland Signature products, particularly in the new ones that we've been introducing.

And then on the fresh side of things, really strong growth across meat, produce and bakery. I would say we've certainly seen a continued acceleration in some of those lower-cost protein items like poultry, cheaper cuts of beef like ground beef and pork….

Management’s view on the retail media opportunity

But we would see it as a significant opportunity over the long term, to drive new revenue. We will approach this probably a little bit differently than many others -- we'll be reinvesting the vast majority of those dollars as we always do to drive top line growth. And we think that will be a competitive advantage with our CPG partners because it will show them that every dollar they're spending is really intended to drive overall growth for the company. That being said, I do think it will help also with e-commerce business is typically less profitable, on this case, a way to offset some of those costs in delivery and fulfillment as well.

E-commerce has lower margins than traditional warehouse shopping

I would still say it's marginally, it's lower than the traditional shopping in the warehouse, and that's obviously intuitively makes sense given that we're doing more of the picking and shopping for the member. As I mentioned in the prepared remarks that we have seen some good improvements as we've grown our sales numbers, that's created some leverage in the model.

We're improving the efficiency of our fulfillment costs. So it is continuing on an improving trend over time because of the sales growth and the leverage that's creating, but also some of the improvements the team are making in the business to drive more efficiency as well.

Average wage of Costco’s employee in US and Canada

Currently, the average wage is just north of $30 an hour.

5. Takeaway

Costco’s value proposition remains strong. The company continues to grow its members, traffic and have high member renewal rates. Executive members which represent almost half of Costco’s membership base but account for 73.5% of sales continues to grow. Costco’s private label, Kirkland Signature, also continues to expand and contribute positively to margins. Costco is transitioning to locally source and produce products in their Asian markets, resulting in lower shipping costs and ultimately passing the reduced costs back to the customer in the form of lower prices.

Overall, Costco’s earnings reflect the company’s strength in an uncertain retail environment. Their strategic focus on giving back cost savings to the customer is reflected in continued membership growth and high renewal rates.

Disclaimer: Please note that none of the information provided constitutes financial, investment, or other professional advice. It is only intended for educational purposes. We have a vested interest in Costco. Holdings are subject to change at any time.