Hingham Institution for Savings (HIFS) Q2 2024 Earnings Update

Implications of a Liability-sensitive Balance Sheet, Unique Loan Underwriting Process, and the Potential Inflection Point

Dear readers,

Due to the earnings season, we’re going to pause the Catch of the Week series for now.

On to the update:

Hingham’s Earnings

Hingham is a small and simple family-run bank headquartered in Massachusetts, primarily focused on real estate mortgage lending. Hingham engages in three activities broadly: (i) commercial real estate lending; (ii) residential real estate lending; and (iii) commercial and personal deposit banking.

Hingham’s focus is so concentrated on these three activities to the point that they have a slide in their annual general meeting every year to show what they do not do. Taken from their 2023 shareholders meeting:

Speaking on the limited variety of their consumer lending business, Patrick Gaughen, President and Chief Operating Officer of Hingham said, “If it floats, flies, or drives – we don’t lend on it”. One thing that stands out is the humble admission that they don’t operate in the segments above because they don’t believe they have an edge in those areas.

At the end of 2023, Hingham’s loan portfolio totaled $3.9 billion comprising about 80% commercial real estate and 13% owner-occupied residential real estate mortgage lending. Practically the entire loan portfolio is secured by real estate mortgage loans. Hingham operates in Massachusetts (~66% of loan portfolio), Washington D.C. (~30% of total loan portfolio) and to a lesser extent, in the San Francisco Bay Area (~3% of total loan portfolio).

Implications of a Liability-sensitive Balance Sheet

Conventionally, banks fund their loans via their deposit base. While Hingham relies on deposits (~58% of total liabilities in FY2023), a big part of their funding comes from short-term wholesale liabilities through the Federal Home Loan Bank (“FHLB”) (~42% of total liabilities in FY2023).

The significant funding from FHLB means that Hingham operates with a liability-sensitive balance sheet, where the bank’s asset maturity and repricing structure are longer compared to its shorter-term liability structure. Put simply, Hingham borrows in the short-term to lend in the long-term.

This means that its liabilities are more sensitive to interest rate changes compared to its assets. For example, an increase in interest rates, especially a rapid increase in short-term interest rates, would increase the bank’s interest expenses much faster than interest income.

Additionally, a sustained period of inversion between the short-term and long-term market interest rates could also have a negative impact on the bank’s profitability.

The good news though, is that the bank’s business model is built to last through economic cycles in the long-term. Although its profitability may suffer in the short-term, the bank will eventually benefit from the interest rate hikes in the medium- to long-term as Hingham’s loans are repriced. New loans originated today will also benefit in the medium- to long-term. And while the adverse effects of the longest ever inverted yield curve are indeed real– it’s likely to temporary.

Interest Rate Hikes and the Inverted Yield Curve

Since March 2022, the Federal Reserve has raised interest rates 11 times; making it the fastest pace of rate hikes since the early 1980s. The rapidity and the quantum of interest rate hikes caused an increase in Hingham’s cost of funds, thereby significantly compressing net interest margins. Unsurprisingly, the stock price has taken a huge hit:

The stock price fell even further in early 2023 following the commercial real estate crisis with the failures of Silicon Valley Bank and First Republic, which is understandable, since most of Hingham’s loans are concentrated in commercial real estate.

While the commercial real estate crisis fears and the compressing net interest margins are certainly valid – the extent that Hingham is successful is the extent they survive long enough for interest rates to fall and/or the inverted yield curve to normalize. Said another way, if Hingham survives, they will thrive.

The key to understanding Hingham’s resilience is to understand how they manage their asset quality.

Hingham’s Unique Loan Underwriting Process

Hingham’s loan underwriting is unique in that they don’t target a minimum or acceptable level of non-performing loans like most banks; they target zero non-performing loans. This means that each and every loan they originate is with the intention of not losing money, and not just managing to an acceptable level of risk.

As part of Hingham’s process, the bank doesn’t allow any one loan officer to approve or authorize loans. All loans have to be reviewed and approved by the entire Executive Committee, which comprises about eight people from the 15-man Board of Directors, who primarily have significant holdings of Hingham shares as a proportion of their net worth (Generally ranging from USD1 million to USD100 million).

Additionally, for loans above USD2 million, and all loans with an aggregate exposure of USD6 million, have to be reviewed and approved by the entire Board of Directors. The Executive Committee meets at least twice a month, or more often as needed, to review and approve loans. Moreover, a member of the Executive Committee will have to perform a site visit for every collateral property.

Given that the Executive Committee has a substantial portion of their net worth in the bank, it’s clear that the incentives are very well aligned; evaluating the borrower’s credit with significant skin in the game suddenly makes it much more serious.

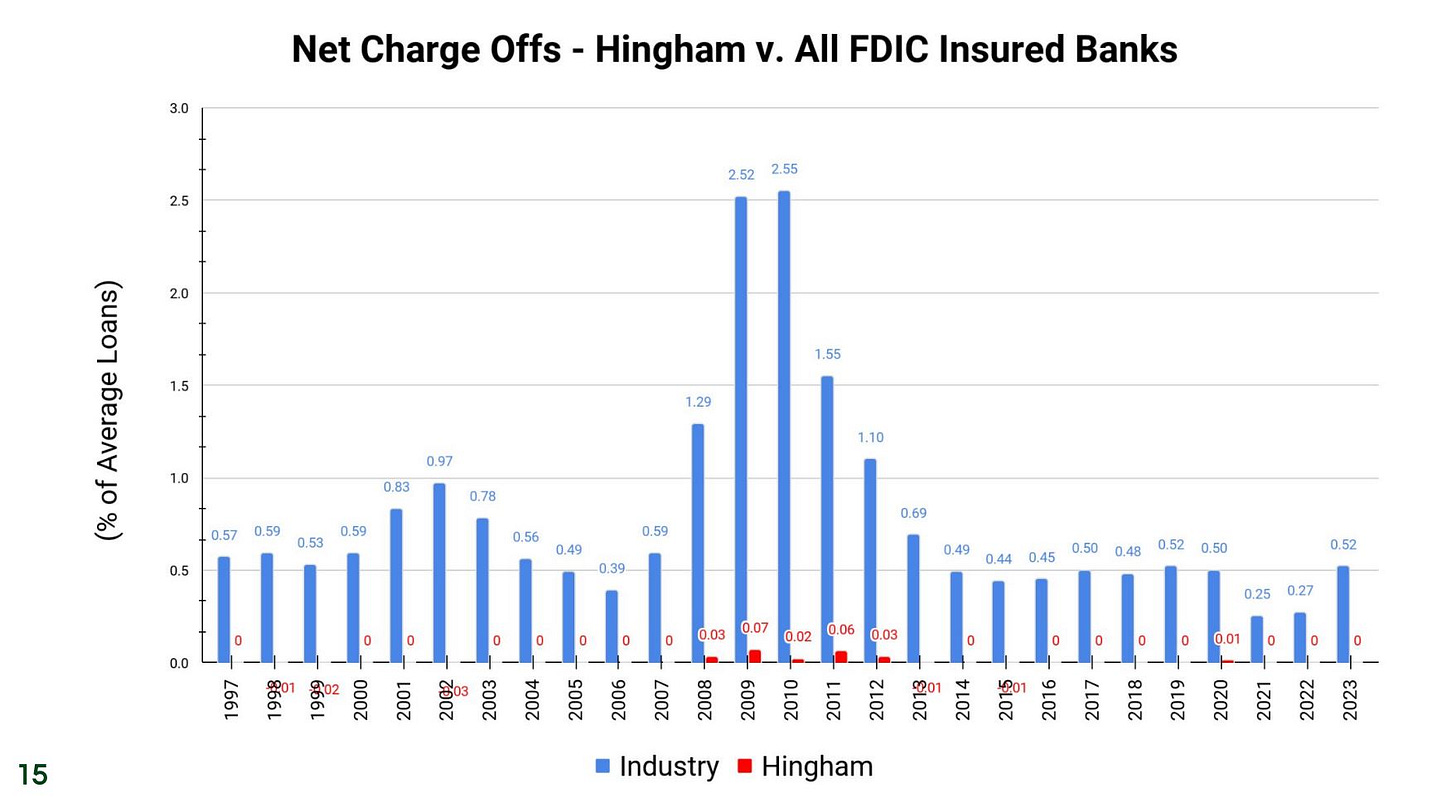

Hingham practically raises the alarm and commences collection procedures once a loan payment is more than 10 days past due on commercial real estate loans, and more than 15 days past due on residential loans. As a result of the stringent process, Hingham’s net charge offs, being actual losses incurred by the bank net of any recoveries, as a percentage of average loans is basically a rounding error compared to the industry. Again, from their 2023 shareholders’ meeting:

A potential counterargument to Hingham’s loan process is whether Hingham even has the ability to scale, given the effort it takes and the people involved to approve a single loan. For perspective, since the Gaughen family took over the bank, net loans have grown from USD76 million in 1993 to USD3,914 million in 2023, with a compound annual growth rate (CAGR) of 13.5% per annum.

What’s more impressive is the fact that they were able to grow net loans by about 51 times larger while generally maintaining head count; in 1993, Hingham had about 88 full time employees (“FTE”) compared to 87 FTEs in 2023. Operating leverage is clearly at play here, perhaps due to technology and process improvements.

The Potential Inflection Point

All that noted, the question of Hingham’s asset quality is clear. Based on the Q2 earnings report, non-performing loans as a percentage of the total loan portfolio was 0.04%; the bank didn’t record any charge-offs for the first six months of 2024 or in 2023. Further, they did not have any delinquent or non-performing commercial real estate loans.

Again, if Hingham is able to survive in the medium-term, then what was initially Hingham’s problem would eventually become Hingham’s gain. Here’s a chart showing the relationship between Hingham’s net interest margin and interest rates over time:

The most important thing to note about the chart is how net interest margin has started to move upwards in the second quarter of 2024. This was the first time that net interest margin expanded since the Federal Reserve started to raise interest rates in early 2022. As explained above, with enough time, Hingham’s assets will continue to reprice, expanding net interest margin. And this is with interest rates holding steady; should interest rates start to fall, net interest margins should increase even further, as evidenced by the 2020 period.

A similar effect can be seen in the periods between 2018 – 2019, albeit at a smaller scale, where net interest margins started to fall as interest rates increased. Net interest margins subsequently picked up again once interest rates started to fall.

To that end, it appears to be a potential inflection point for Hingham’s compressed net interest margins. While the future direction of interest rates is uncertain, what is clear is Hingham’s pristine asset quality, which could be the key in turning the interest rate headwinds into a tailwind.

Disclaimer: Please note that none of the information provided constitutes financial, investment, or other professional advice. It is only intended for educational purposes. We have a vested interest in Hingham Institution for Savings. Holdings are subject to change at any time.