Meta Q2 2024 Earnings Update

Meta AI, AI Infrastructure, Facebook, Threads, WhatsApp and Meta Smart Glasses

Meta AI

Meta AI use cases range from utilitarian to creative

Some of the use cases are utilitarian like searching for information or role-playing difficult conversations before you have them with another person. And other uses are more creative like the new Imagine Yourself feature that lets you create images of yourself doing whatever you want in whatever style you want. And part of the beauty of AI is that it's general, so we're still uncovering the wide range of use cases that it's valuable for.

Meta AI will improve engagement in existing products and as Meta AI scales, monetization should follow

So realistically, for things like Meta AI or AI Studio, I mean, these are things that, I think, will increase engagement in our products and have other benefits that will improve the business and engagement in the near term.

But before we're really talking about monetization of any of those things by themselves, I mean, I don't think that anyone should be surprised that I would expect that, that will be years, right? It's just -- I think that that's like what we've seen with Reels. It's what we saw with all these things.

But I think for those who have followed our business for a long time, you can also get a pretty good sense of when things are going to work years in advance. And I think that the people who bet on those early indicators tend to do pretty well, which is why I wanted to share in my comments the early indicator that we had on Meta AI, which is, I mean, look, it's early. Last quarter, we -- I think it just started rolling it out a week or 2 before our earnings call. This time, we're a few months later.

And what we can say is, I think, we are on track to achieve our goal of being the most used AI assistant by the end of this year. And I think that's a pretty big deal. Is that the only thing we want to do? No. I mean we obviously want to kind of grow that and grow the engagement on that to be a lot deeper, and then we'll focus on monetizing it over time. But the early signals on this are good, and I think that that's kind of all that we could reasonably have insight into at this point.

Creating your own tailored AI agents to help businesses and creators engage with more people

An important part of our vision is that we're not just creating a single AI but enabling lots of people to create their own AIs. And this week, we launched AI Studio, which lets anyone create AIs to interact with across our apps. I think the creators are especially going to find this quite valuable. There are millions of creators across our apps, and these are people who want to engage more with their communities, and their communities want to engage more with them. But there are only so many hours in the day.

So now they're going to be able to use AI Studio to create AI agents that can channel them to chat with their community, answer people's questions, create content and more. So I'm quite excited about this. But this goes beyond creators, too. Anyone is going to be able to build their own AIs based on their interests or different topics that they are going to be able to engage with or share with their friends.

Business AIs are the other big piece here. We're still in alpha testing with more and more businesses. The feedback we're getting is positive so far. Over time, I think that just like every business has a website, a social media presence and an e-mail address, in the future, I think that every business is also going to have an AI agent that their customers can interact with. And our goal is to make it easy for every small business, eventually every business, to pull all of their content and catalog into an AI agent that drives sales and saves them money. When this is working at scale, I think that this is going to dramatically accelerate our business messaging revenue.

AI Infrastructure

Expect significant capex growth in 2025

We anticipate our full year 2024 capital expenditures will be in the range of $37 billion to $40 billion, updated from our prior range of $35 billion to $40 billion. While we continue to refine our plans for next year, we currently expect significant CapEx growth in 2025 as we invest to support our AI research and our product development efforts.

Better to be early building out AI infrastructure than to risk being late

Another major area of focus is figuring out the right level of infra capacity to support training more and more advanced models. Llama 3 is already competitive with the most advanced models, and we're already starting to work on Llama 4, which we're aiming to be the most advanced in the industry next year. We are planning for the compute clusters and data we'll need for the next several years. The amount of compute needed to train Llama 4 will likely be almost 10x more than what we used to train Llama 3. And future models will continue to grow beyond that.

It's hard to predict how this trend -- how this will trend multiple generations out into the future. But at this point, I'd rather risk building capacity before it is needed rather than too late given the long lead times for spinning up new infra projects. And as we scale these investments, we're, of course, going to remain committed to operational efficiency across the company.

Building AI infrastructure with fungibility

The other thing I would say is we're continuing to build our AI infrastructure with fungibility in mind so that we can flex capacity where we think it will be put to best use. The infrastructure that we build for GenAI training can also be used for GenAI reference -- inference. We can also use it for ranking and recommendations by making certain modifications like adding general compute and storage. And we're also employing a strategy of staging our data center sites at various phases of development, which allows us to flex up to meet more demand and less lead time if needed while limiting how much spend we're committing to in the outer years. So while we do expect that we are going to grow CapEx significantly in 2025, we feel like we have a good framework in place in terms of thinking about where the opportunities are and making sure that we have the flexibility to deploy it as makes the most sense.

Why Meta Open Sources AI

Like I talked about, I think -- the reason why open sourcing, this is so valuable for us is that we want to make sure that we have the leading infrastructure to power the consumer and business experiences that we're building. But the infrastructure, it's not just a piece of software that we can build in isolation. It really is an ecosystem with a lot of different capabilities that other developers and people are adding to the mix whether that's new tools to distill the models into the size that you want for a custom model or ways to fine-tune things better or make inference more efficient or all different other kinds of methods that we haven't even thought of yet, the silicon optimizations that the silicon companies are doing, all the stuff. It's an ecosystem.

So we can't do all that ourselves. And if we built Llama and just kind of kept it within our walls, then it wouldn't actually be as valuable for us to build all the products that we're building as it's going to end up being. So that's the business strategy around that. And that's why we don't feel like we need to necessarily build a cloud and sell it directly in order for it to be a really positive business strategy for us. And part of what we're doing is working closely with AWS, I think, especially did great work for this release. Other companies like Databricks, NVIDIA, of course, other big players like Microsoft with Azure and Google Cloud, they're all supporting this.

And we want developers to be able to get it anywhere. I think that that's one of the advantages of an open source model like Llama, is it's not like you're locked into one cloud that offers that model whether it's Microsoft with OpenAI or Google with Gemini or whatever it is. You can take this and use it everywhere, and we want to encourage that. So I'm quite excited about that.

Facebook

Groups and Marketplace are driving engagement with young adults on Facebook

…I'm particularly pleased with the progress that we're making with young adults on Facebook. The numbers we're seeing, especially in the U.S., really go against the public narrative around who's using the app. A couple of years ago, we started focusing our apps more on 18 to 29 year olds, and it's good to see that those efforts are driving good results…

…So building products with young adults in mind has been a core priority area for the Facebook team in recent years, and we've been very encouraged to see these efforts translate into engagement growth with this cohort. We've seen healthy growth in young adult app usage in the U.S. and Canada for the past several quarters. And we've seen that products like Groups and Marketplace have seen particular traction with young adults. Posting to Groups in the U.S. and Canada has been growing. That's been boosted mainly by young adults. And we also see that they are active users of Marketplace, which has benefited from product improvements and strong demand for secondhand products in the U.S….

Moving towards a single, unified recommendation system across Facebook

…This quarter we rolled out our full-screen video player and unified video recommendation service across Facebook -- bringing Reels, longer videos, and Live into a single experience. This has allowed us to extend our unified AI systems, which had already increased engagement on Facebook Reels more than our initial move from CPUs to GPUs did. Over time, I'd like to see us move towards a single, unified recommendation system that powers all of the content including things like People You May Know across all of our surfaces. We're not there, so there's still upside -- and we're making good progress here.

Threads

Threads is about to hit 200m MAU

…Another bright spot is Threads, which is about to hit 200 million monthly actives. We're making steady progress towards building what looks like it’s going to be another major social app. We're seeing deeper engagement and I'm quite pleased with the trajectory here…

Reminder that Meta’s product cycle is different, usually takes several years to scale before focusing on monetization

Threads, I think it's another example of something that it got off to about as good of a start of any app that I can think of. I think it was the fastest-growing app to 100 million people. And it's a good reminder that even when you have that start, the path from there to 1 billion people using an app is still multiple years. And that's our product cycle.

And I think that that's something that is a little bit different about Meta in the way we build consumer products and the business around them than a lot of other companies that ship something and start selling it and making revenue from it immediately. So I think that's something that our investors and folks thinking about analyzing the business, if needed, to always grapple with, is all these new products. We ship them and then there's a multiyear time horizon between scaling them and then scaling them into not just consumer experiences but very large businesses.

But the thing that, I think, is just super exciting about Threads is that we've been building this company for 20 years, and there are just not that many opportunities that come around to grow 1 billion-person app. I mean there are, I don't know, maybe a dozen of them in the world or something, right? I mean there are certainly more of them outside the company than inside the company, but we do pretty well, and being able to add another one to the portfolio if we execute really well on this is just really exciting to have that potential.

WhatsApp

WhatsApp now has more than 100 million MAUs in the US

So the WhatsApp stat, I think, is really important as a business trend just because the United States punches above its weight in terms of it's such a large percent of our revenue. So before, WhatsApp was sort of the leading messaging app in many countries around the world but not in the U.S. And I think now that we're starting to make inroads into leading in the U.S. as more and more people use the product and realize that, hey, this is a really good experience, the best experience for cross-platform communication and groups and on all these different things, I think that that's going to just mean that all of the work that we're doing to grow the business opportunity there over time is just going to have a big tailwind if the U.S. ends up being a big market. So that's one reason why it's really relevant.

Meta Smart Glasses

Ray-Ban Meta Smart Glasses showing early traction

…and Ray-Ban Meta smart glasses are showing very promising traction with the early signals that we are seeing across demand, usage and retention, increasing our confidence in the long-run potential of AR glasses…

…Ray-Ban Meta glasses continue to be a bigger hit sooner than we expected, thanks in part to AI. Demand is still outpacing our ability to build them, but I'm hopeful that we'll be able to meet that demand soon…

…On the smart glasses, EssilorLuxottica is a great partner. We are now in the second generation of the Ray-Ban Meta glasses. They're doing well, better than I think we had expected, and we expected them to grow meaningfully from the first generation, so that's been a very positive surprise. And I think part of that is that it's just well positioned to dovetail well with the AI revolution that we're seeing and offering all kinds of new functionality there. So that was great.

But EssilorLuxottica is a great company that has a lot of different products that we hope to be able to partner with to just continue building new generations of the glasses and deepen the AI product and make it better and better. I think there's a lot more to go from here. And compared to what we thought at this point, it's doing quite well compared to, I think, what it needs to be, to be like a really leading piece of consumer electronics. I think we're still early, but all the signs are good…

Takeaway

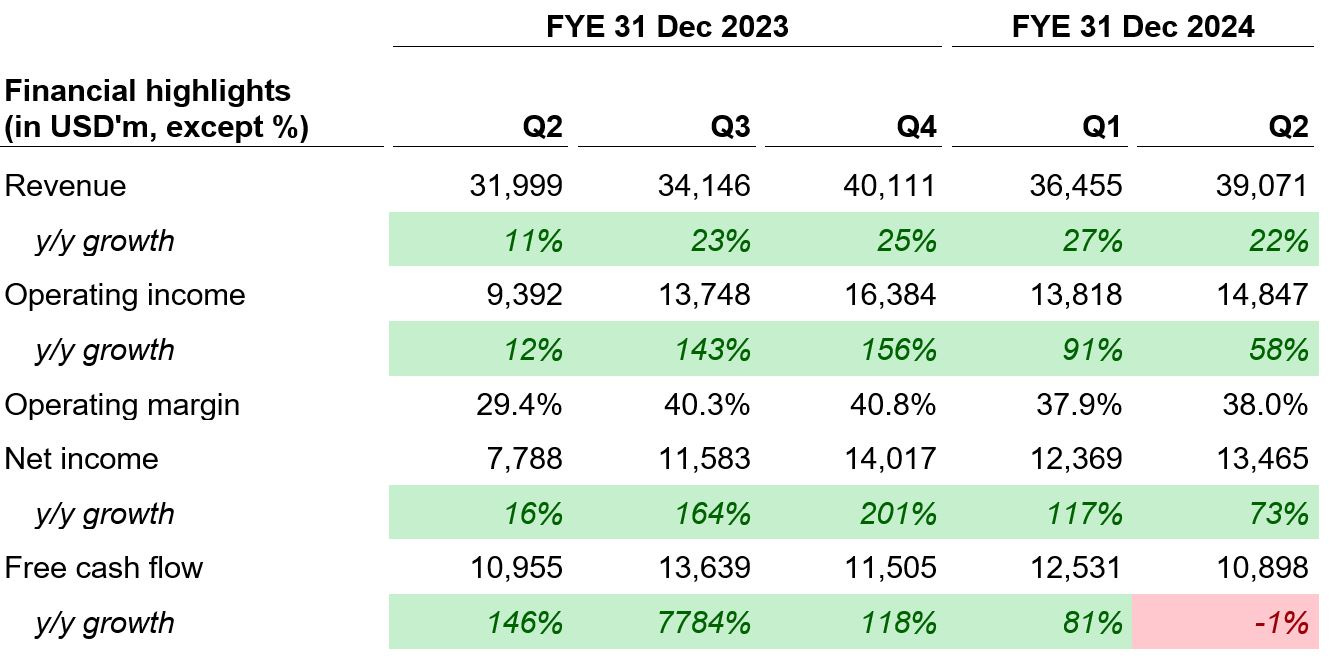

Meta continues to be a key beneficiary of the AI revolution. As the technology is still relatively nascent, there’s likely to be loads of upcoming product innovation. Meta’s core business remains strong with recommendation and efficiency improvements from AI. Business messaging from WhatsApp, Threads, and Meta AI are potentially the next levers for growth. Their Reality Labs segment continues to be loss making, but Meta Smart Glasses shows early promising traction as demand outpaces supply.

Meta’s playing the long game here by investing in the AR/VR space and building out their AI infrastructure. As Zuck noted, it’s better to build out capacity earlier before it’s needed, than to risk being late. For now, Meta is executing well on its core advertising business while investing for the future. It’ll be interesting to see how the race for the development of the next computing platform develops with Meta being the front runner.

Disclaimer: Please note that none of the information provided constitutes financial, investment, or other professional advice. It is only intended for educational purposes. We have a vested interest in Meta Platforms Inc. Holdings are subject to change at any time.