Netflix: Profitability Takes Center Stage as Growth Reaccelerates

Netflix (NFLX) Q3 2024 Earnings Analysis

Table of Contents

About Netflix

Business Analysis

Financial Analysis

Earnings Call Highlights

Takeaway

1. About Netflix

Netflix provides entertainment services including TV series, films, documentaries, stand-up comedy specials, reality TV, anime, live events, games and sports related content to over 260 million memberships in over 190 countries. Netflix provides members the ability to receive streaming content through a host of internet-connected devices including TVs, digital video players, television set-top boxes and mobile devices.

Netflix derives revenues using a subscription-based model from monthly membership fees.

2. Business Analysis

Paid memberships

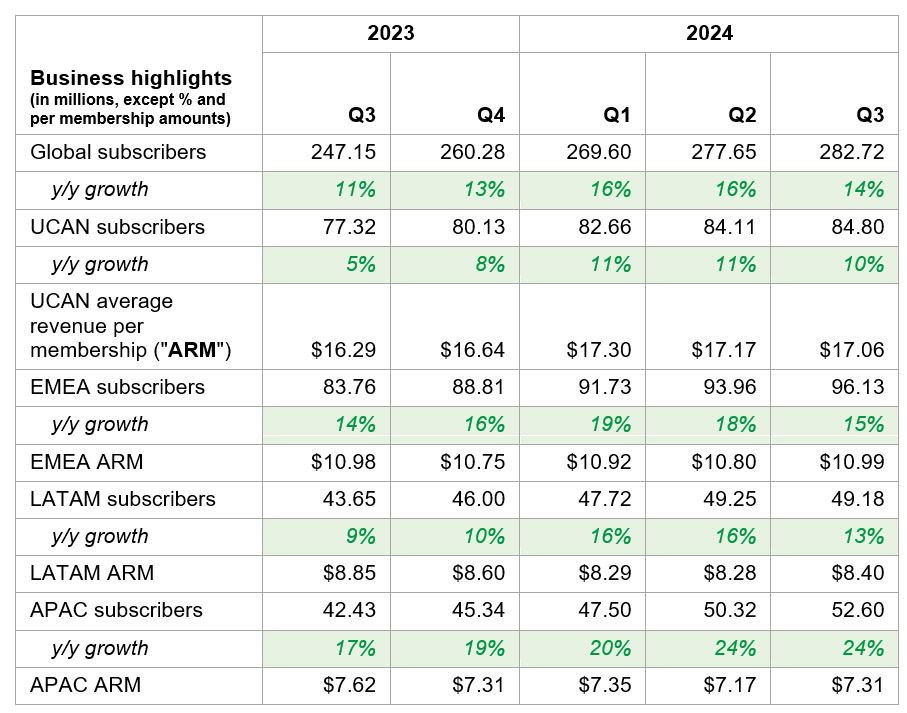

Subscriber growth continues its acceleration. In Q3, global paid memberships reached 282.72 million, representing a 14.4% y/y increase from 247.15 million. There were 5.07 million paid net additions compared to last quarter.

UCAN paid memberships reached 84.8 million, representing a 10% y/y increase from 77.32 million. There were 0.69 million paid net additions compared to last quarter. UCAN ARM was $17.06, up 5% y/y.

EMEA paid memberships reached 96.13 million, representing a 15% y/y increase from 83.76 million. There were 2.17 million paid net additions compared to last quarter. EMEA ARM was $10.99, stable from last year.

LATAM paid memberships reached 49.18 million, representing a 13% y/y increase from 43.65 million. Paid net additions decreased by 0.07 million compared to last quarter. Management noted that the slight decrease was due to recent price changes in some of their bigger LATAM markets which dampens short-term member growth. The good news though, is that management has already started to observe a rebound at the beginning of Q4. They said that if the quarter lasted one more day, paid net additions would be up instead. LATAM ARM was $8.40, down 5% y/y.

APAC paid memberships reached 52.6 million, representing a 24% y/y increase from 42.43 million. There were 2.28 million paid net additions compared to last quarter. APAC ARM was $7.31, down 4% y/y.

3. Financial Analysis

Revenue

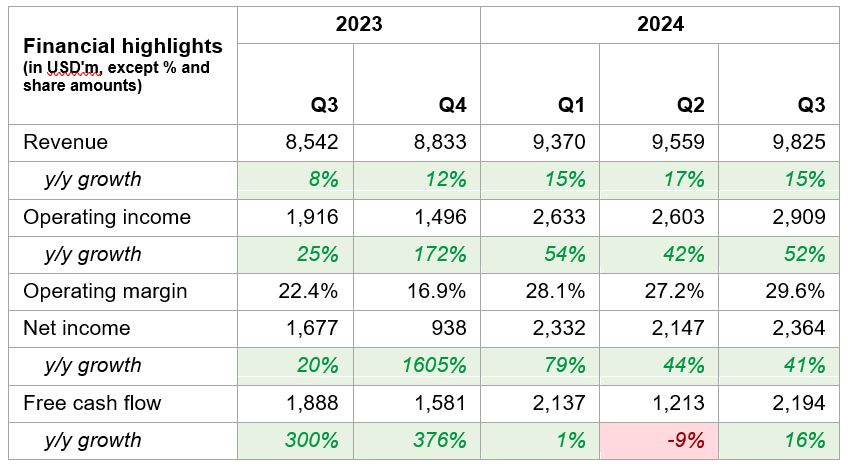

For Q3, streaming revenues reached $9.82 billion, representing a 15% y/y increase. This was primarily due to growth in average paying memberships and price increases, partially offset by unfavorable changes in foreign exchange rates.

It’s clear that the company’s initiatives to re-accelerate growth since the slowdown in 2022 have been bearing fruit. The management’s response to the revenue slowdown and subscriber decline is indicative of their quality. Their initiatives since then, namely the launch of the ad-supported tier, password sharing crackdown, investing in localized content, and pricing adjustments are clearly impacting revenue growth.

Profitability

In Q3, Netflix’s operating income reached $2.9 billion, up 52% y/y. Operating margin expanded significantly to 29.6%, up from 22.4% in the same quarter in 2023.

As Netflix’s revenue re-accelerates, they’ve managed to keep operating expenses under control, indicating clear signs of operating leverage. Looking at the operating expenses below:

Marketing expenses increased by 15% y/y, reaching $643 million. As a percentage of revenue, marketing expenses remained stable at 7% compared to the same quarter in 2023.

Technology and development expenses rose by 12% y/y, reaching $735 million. As a percentage of revenue, technology and development expenses decreased to 7%, down from 8% a year ago.

General and administrative expenses fell by 15% y/y, reaching $417 million. As a percentage of revenue, general and administrative expenses decreased to 4%, down from 6% a year ago.

Free Cash Flow

Netflix delivered a free cash flow of $2.19 billion, marking a 16% increase y/y. In recent quarters, Netflix has been generating strong free cash flow.

For the full year of 2024, Netflix expects a free cash flow of $6.0 billion – $6.5 billion, up from $6 billion due to higher operating income forecast.

Balance Sheet

Netflix raised $1.8 billion in their first investment grade bond deal during the quarter. This resulted in total debt increasing to $16 billion from $14 billion in the previous quarter, but net debt decreased to $6.8 billion from $7.4 billion in the previous quarter. This isn’t a strong balance sheet – but with the strength of the business, high quality management team, and strong free cash flow generation, and lowered debt levels (For context, Netflix’s debt-to-equity ratio was at a peak of 2.2 in 2019, and it’s 0.8 in 2023), we’re not too worried.

4. Earnings Call Highlights

Engagement is healthy; users watch Netflix for an average of two hours a day

…engagement, which we view as our best proxy for member happiness because when people watch more, they stick around longer. So, that's retention. They talk more about Netflix, which drives acquisition….

…This year, we've maintained very healthy engagement, about two hours of viewing per member per day, and engagement on a per-owner household is up through the first three quarters of 2024….

Reworking the TV homepage

…Also improving the product experience. We tested a new more intuitive version of our TV homepage. We're excited about the progress that we've seen there, so we're polishing it up, and we're excited to bring that to our subscribers around the world….

Majority of growth for 2025 should be driven by memberships

…So, we expect to deliver roughly $43 billion to $44 billion of revenue next year based on FX rates at the end of Q3. That represents about $4 billion to $5 billion of incremental revenue over our kind of 2024 expected landing where -- think of it as about 11% to 13% growth. And that's from a combination of membership and ARM growth. The majority of growth next year, we expect to be membership-driven growth.

It's from the full year impact of this year's strong net adds plus solid paid net adds expected next year. We still have hundreds of millions of households that aren't members, and we'll grow into that opportunity, thanks to a great '25 slate and our improvements in converting consumer demand, and we will have ARM growth. ARM's a combination of continued plan evolution and pricing, building off the actions we've been taking this year, and growing our ads revenue, as Greg just talked about, not yet a primary growth driver but to be a more meaningful contributor in '25. So, overall, healthy double-digit revenue growth, more balanced across multiple drivers, and strong outlook….

Room for operating margin expansion in the future

…So, as we said in the letter, we see plenty of room to increase our margins over the long term. And we feel great about what we're delivering in '24. We expect to be up 6 percentage points, as Ted mentioned, and our approach to margin is unchanged.

We believe we build a stronger and more lasting business by gradually increasing margins as we grow. We set margin targets, and we do that by investing to improve our service while making trade-offs and prioritizing like growing our costs slower than revenue and operating like owners. The amount of margin growth each year, it will bounce around a bit based on the strategic opportunities in a given year, FX moves, and things like that, but we'll aim to increase each year. And what you see in our '25 guide is consistent with that approach….

Ads plan accounted for over 50% of sign-ups in their ads countries

…I would say the most important part is we've been carrying two top-level priorities when we think about our ads business.

Priority No. 1 was we have to grow our ad tier membership so that we can get to sufficient scale to be relevant in each market for advertisers. And the big priority No. 2 is we have to improve our capabilities and attractiveness to advertisers and therefore the monetization of all that inventory.

So, on that first one, we've made some really solid progress. Q3, we mentioned in the letter, ads plan accounted for over 50% of sign-ups in our ads countries. That's a leading indicator about how you think about sort of ads membership there. Our ads plan membership base was up 35% quarter over quarter….

Ads plan membership continues to grow strongly

…Our ads plan membership base was up 35% quarter over quarter. That's over probably four quarters of really significant growth as well. So, that's growing nicely. As we said last quarter, we expect to be at critical scale as our advertising partners tell us they need us to be in each of our 12 ads countries in 2025….

Engagement in ads plan members are similar to non-ads plan members

…Our ads plan members are watching similar amount of view hours and similar titles, too, which is probably interesting to note, relative to comparable non-ads plan members. So, this was our top area of improvement….

Netflix is scaling their audience and ad inventory faster than they can monetize it

…our second priority, and that's effectively monetizing all that growing inventory.

I think it's worth noting we've got a lot of work still ahead of us to achieve that goal, to make our offering better for advertisers. It's going to be a priority for us for several years coming, but we're moving. Our first-party ad server, which is a key component of unlocking value in the space, that's on track to launch in Canada this quarter and then the rest of our ad markets in 2025. We've got our partnerships with Trade Desk and Google Live, and those are going well.

We've got a road map for more formats, for more features, for more measurement. That's all coming. So, while we've got lots of work to do, we are very confident in our ability to execute and grow our ad business much like we did with the paid sharing initiative….

… We see ads revenue growth on a good trajectory. We've got healthy CPMs at the high end of that premium CTV ad market.

That's where we want to be positioned. And while ads won't be a primary driver of revenue in 2025, because we're still scaling that audience and that inventory faster than our ability to monetize it, we definitely see already the momentum growth in the monetization and our opportunity to close that gap. So, for 2025, we expect that ads revenue will roughly double year over year, albeit off a small base. But just as a confidence point in that, this year's U.S. upfront, we're seeing 150% -- over 150% increase in our ads sales commitments. So, I think it's also worth noting that like ads against premium video, it's a proven model. So, if we take the potential size of that opportunity, the growth trajectories that we are seeing, that's what makes us so excited about ads being able to be one of those growing levers to support our sustaining healthy revenue and profit growth in the years to come….

On Netflix partnering with the Trade Desk vs. building their own walled garden…

…As to Rich's walled garden question, I would say we've learned not to be too rigid in our position. So, we're going to always evaluate and will evolve based on how our business is evolving and, frankly, how the ecosystem is evolving around us. But we believe these partnerships are very positive for us….

Going forward, Netflix should have a normalized output schedule

…So, a drumbeat so steady that when you're watching the last episode of whatever you're watching, you start expecting the next thing to be great, too. However, in the first half of this year, our lineup was much lumpier than we liked.

And that was primarily because of the work stoppage. It did hit UCAN the hardest, but there were some effects of that felt in production around the world. We're moving closer and closer to a more normalized output schedule now. Series a little more on track than film, but neither fully, fully recovered….

Giving the most value to the customer by providing the content immediately as they are released, as opposed to a theatrical release or weekly release schedule

…Look, I'm just going to reiterate, we are in the subscription and entertainment business. And you can see in our results it's a pretty good business, and it appeals to a very large segment of consumers and fans. Our top 10 films that premier on Netflix all have over 100 million views, among the most-watched films in the world.

It's our desire to kind of keep adding value to our consumers for their subscription dollar. We believe that not making them wait for months to watch the movie that everyone's talking about adds that value….

YouTube is a competitor, but also complementary to Netflix’s business

…When I look at YouTube specifically, I'd say look, we compete directly with YouTube for people's time, for the time they spend on that TV screen. But we have very different strengths.

And we continue to invest in ambitious premium content to grow our share of engagement. We think that Netflix is the best place for premium stories because we're the home to the best storytellers. We have an enormous reach, 600 million watchers. We assume the financial risk when you're making your content.

Our subscription model generates higher returns for creators. Those higher returns let them make more ambitious investments in their next projects. So, Netflix and YouTube, while we do compete for that time, we're interestingly complementary as well. So, we put up our trailers on YouTube, and they get a lot of viewing, which is great because it drives a lot of viewing on Netflix….

… I think that Netflix fulfills an important and different role for both consumers who want these great movies and TV shows but also for creators who want partners that can share in the risk that's inherent to bringing those stories to life. And if you think about some of the titles we'll launch this quarter, you mentioned a couple: Squid Game, Outer Banks, Black Doves. You mentioned A Hundred Years of Solitude, Senna, both coming from Latin America, which are huge, ambitious projects.

It's hard to imagine how those kind of big creative bets would be possible with YouTube's model. So, while it's certainly a competitive environment, that's absolutely true, but we feel our focus and our model, which is the best storytellers, ambitious premium storytelling, those work well for consumers and for creators while also generating significant operating margin for the business, too….

By paying talent upfront, Netflix assumes the financial risk and stands to benefit from potential success

…Look, we like our model and talent likes our model. It's so much more impactful for our business if we can make our films, our shows just a little bit better, so much more impactful than making them a little bit cheaper. Bela said this very clearly a couple of weeks ago to all the talent agencies.

We're not changing our compensation structure. Paying upfront, something that Netflix actually pioneered, benefits creators and it benefits Netflix. So, for creators, Netflix takes all the financial risks so that they can focus on making the best possible version of what they're working on. And for Netflix, that model enables us to attract the best talent in the world.

Now with all that said, we have been and we continue to be and we are open to more bespoke deals where talent is interested. Now they rarely happen because typically the talent chooses the upfront model. So, we think that we have the right model, and we are not looking to change it….

5. Takeaway

Netflix is in a strong position. Netflix has brought their revenue growth back to double digits through various initiatives such as password sharing crackdown and their ad-supported tier. To strengthen their offerings and to act as future growth levers, they are investing in developing games based on popular IPs (Squid Game, Virgin River), expanding into live programming (Mike Tyson vs Jake Paul, NFL and WWE). Their advertising business is growing and should be a more meaningful contributor to revenue in 2026 onwards.

Netflix is also profitable and is generating positive free cash flow, unlike most of their streaming competitors. A key indicator of Netflix arguably “winning” the streaming wars was when competitors decided to license its content to Netflix, at a time where studios were desperate to boost their bottom line. Importantly, Netflix’s share of viewership, even in the biggest countries, is still less than 10% of TV time. Overall, Netflix remains in a position of strength with room to grow and expand profitability.

Disclaimer: Please note that none of the information provided constitutes financial, investment, or other professional advice. It is only intended for educational purposes. We have a vested interest in Netflix. Holdings are subject to change at any time.