Netflix Q2 2024 Earnings Update

Operating Leverage and the Value Translation Mechanism, Advertising Continues to Scale and Netflix’s Sports Play

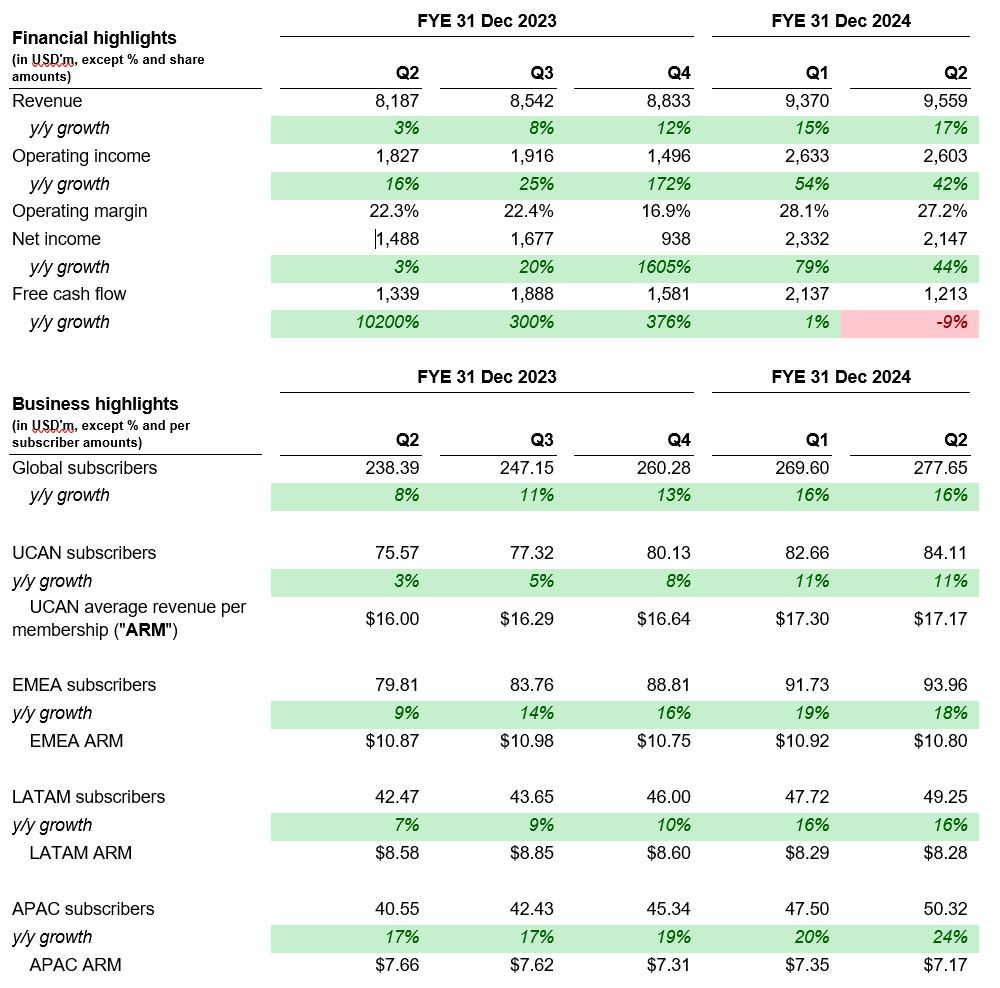

Netflix had a fairly strong quarter: revenue continues to grow, operating margins continues to expand, and free cash flow remains strong. However, this wasn’t always the case. Here’s a chart showing how those metrics have trended over time:

Operating Leverage and the Value Translation Mechanism

Although Netflix’s revenue has always been healthy, the same cannot be said about their free cash flow. For context, back in Q4 2014, the company came to the realization that original content (as opposed to licensed content) was their most efficient content; original content cost less money relative to their viewing metrics than most of their licensed content.

Netflix then decided to grow their original content spend which required more upfront cash, dampening free cash flow for years. It took them about five years for their investments in original content to mature, and with the help of the pulled forward demand from the Covid-19 pandemic in 2020, free cash flow was finally positive. In Q4 of 2020, they explained that they no longer needed to raise external financing for their day-to-day operations. And finally in Q3 of 2021, Netflix guided to be sustainably free cash flow positive in 2022 and beyond.

Similarly, Netflix’s operating margin has been on a strong uptrend. In the most recent quarter, Netflix raised their operating margin guide to 26%, up slightly from 25%. What’s more impressive is that it isn’t done expanding. Netflix committed to continually expand operating margins every year. From the Q2 2024 shareholder letter:

Our goal is to increase our operating margin each year, though the rate of expansion will vary year to year.

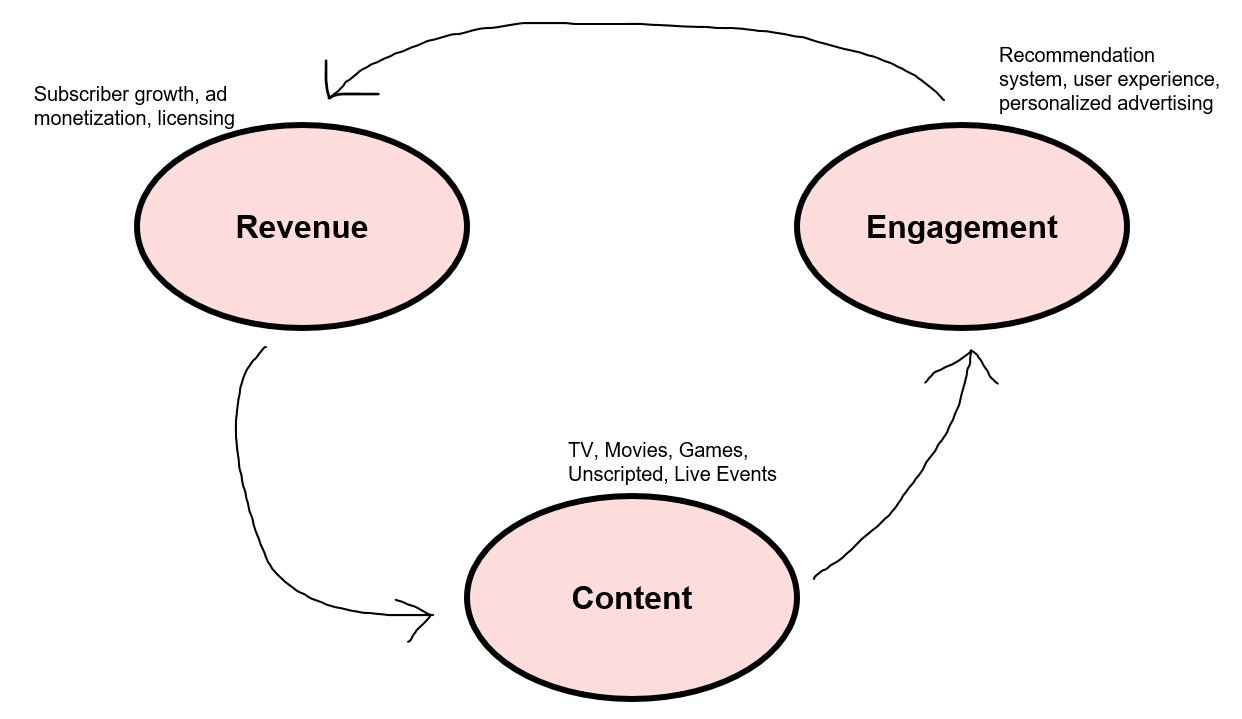

To broadly visualize the flywheel that Netflix spins, here’s a little diagram:

The above illustrates that content is turned into engagement; management calls this process the value translation mechanism. As the flywheel goes: content is produced, and the value translation mechanism extracts the most business value out of the content, turning it into revenue dollars for Netflix.

One way is through paid sharing. It may seem hypocritical of Netflix to be cracking down on password sharing because this was the same company that tweeted the following back in 2017:

This was another great example of how Netflix can be quick to completely change their stance when the facts change (another being anti-advertising); when the pandemic pulled forward demand, subscriber growth and revenue slowed, Netflix needed to crackdown on password sharing to tap into the estimated over 100 million additional households that were essentially using Netflix for free.

Netflix is now at the point where they’ve operationalized paid sharing, that is, they view paid sharing as part of the standard product experience. One point to note though, is that Ted Sarandos, co-CEO of Netflix, talked about how they anticipated engagement to take a hit from paid sharing. This, however, was not the case as engagement held steady, which probably speaks to the quality of the product.

Another way is through sign-up flows, which is the user experience that a consumer has when they want to sign up for Netflix. Gregory Peters, co-CEO of Netflix, explained that they found that multiple improvements over the last few quarters meant significant incremental revenue gains.

We can probably expect management to experiment with a variety of ways, amongst others, such as plan optimization, pricing, merchandising and ads revenue.

Advertising Continues to Scale

Netflix’s advertising segment continues to grow and they are on track to achieve their critical-scale goals for all of their ad countries in 2025. Peters described that there were two main fronts on the ad segment: go-to-market capability and the product and technology stack. Peters on the earnings call:

And there's sort of 2 main fronts here. One is our go-to-market capability. So we're adding more sales folks, we're adding more ads operation folks, building our capabilities to meet advertisers. A big component of that is giving advertisers more effective ways to buy Netflix. It's a big point of feedback that we heard from advertisers. So by adding demand sources that are already integrated into their processes and their systems, that just makes it easy for them to buy. And in some cases, that was a threshold item for them to buy in us, so we're going to expand the number of buyers as a result of that.

And then the other big area of growth for us is the sort of product and technology stack. We mentioned we're building our own ads server now. We're excited to launch that in Canada this year and then the rest of our ads markets in '25. That unlocks a whole set of innovations that we expect that are focused on a better user experience for our members on those ad tiers and better advertiser features. So think a lot about this as targeting relevance, more capabilities in that space as well as thinking about how do we do ROI, ROAS, incrementality measurements, all the things that we want.

For now, ads average revenue per member (“ARM”) is lower than the non-ads ARM. The reason for this is because Netflix has been scaling their ads so rapidly that they’re behind on inventory. And as they scale up their ads, Peters claimed that engagement on their ads plans is very similar to their non-ads plans; here’s Peters again:

…our engagement on our ads plans is very similar to what we see on our non-ads plans. That's close to the approximately 2 hours of viewing per member per day across all the plans that you can calculate globally from our engagement reports. So you should think of that as roughly how our ads plan members are engaging as well.

Again, the fact that engagement has not fallen significantly with ads suggests that there is an untapped market; ads offer a lower entry point to be more accessible for more people. Perhaps the question should be: why didn’t Netflix offer advertising earlier?

Netflix’s Sports Play

Once upon a time, Netflix did not touch sports; they didn’t like the economics of live sports. This was understandable, given that live sports can be very costly; major leagues command astronomical fees and so rights acquisition would be expensive. Until now, the only sports play they’ve made is storytelling.

This changed through Netflix’s venture into sports through the NFL games and WWE. Keep in mind though, that this isn’t through the conventional route, it’s through an event-based model, which is more profitable. Sarandos elaborates on sports as an event-based model:

Well, hopefully, exactly the way we're doing it: by making these Netflix events, not necessarily taking on a lot of tonnage from any one league but actually making these games, events, like having 2 NFL football games on Christmas Day and 2 great games, the Chiefs and the Steelers and the Ravens and the Texans, they're both going to be great games, and it really creates a lot of real excitement with the service, and it's one day of football.

So when I look at that and think along those lines, you can see how we solved for that in our WWE deal, which was economics that we like and live with and can grow into and contemplate with that expansion of cost and viewing would be, in that case, as long as 20 years if we want it to be. So I think it's really not a matter of there's an automatic disconnect between you can't do sports and have profit. It's very difficult to have big league sports and profit when you offer them in entire seasons. But when you offer them in this event model that we're building on, we're really excited about our opportunity to do that without the risk that you're talking about right now.

Games

Their games segment continues to grow and engagement looks strong. Here’s Peters with an update on games:

Games is a big market. It's almost $150 billion ex China and Russia, and not including ad revenue, which we aren't participating in, in our current model. And we're getting close to 3 years into our gaming initiative, and we're happy with the progress that we've seen. We've had set ourselves pretty aggressive engagement growth targets. And we've met those, exceeded those in many cases. In 2023, we tripled that engagement. We're looking good in our engagement growth in '24, and we've set even more aggressive growth goals for '25 and '26.

But worth noting that, that engagement and that impact on our overall business at the current scale, it's still quite small. And it's also probably worth noting that the investment level in games relative to our overall content spend is also quite small. And we've calibrated the growth in investment with the growth in the business impact. So we're being disciplined about how we scale that. So now obviously, the job is to continue to grow that engagement to the place where it has a material impact on the business.

I think you've seen this trajectory with us before, whether it's been a new content genre like unscripted or film or maybe getting the content mix right for a particular country, you can think about Japan or India, which we're now in an amazing place through the hard work of our teams there. We continually iterate. We refine our programming based on the signals we get from our members. And if you look over several years with that model, we can make a huge amount of progress.

We've launched over 100 games so far. We've seen what works, what doesn't work. We're refining our program to do more of what is working with the 80-plus games that we currently have in development. And one of those things that really is working is connecting our members with games based on specific Netflix IP that they love. And this is an area that we've been able to move in quickly in a particular space, which is interactive narrative games. These are easier to build. And we place those in a narrative hub that we call Netflix Stories. Q2, we launched Virgin River and Perfect Match. Starting this month in July, we're going to launch about 1 new title per month into Netflix Stories, and this is amazing IP like Emily in Paris and Selling Sunset. And we have lots more, including very different types of games yet to come in the quarters and years ahead.

Moreover, Netflix hinted that games could be able to influence the story of upcoming content; Sarandos on the potential influence of games:

But I think our opportunity here to serve super fandom with games is really fun and remarkable. I think the idea of being able to take a show and give the superfan a place to be in between seasons and even beyond that, to be able to use the game platform to introduce new characters and new storylines or new plot twist events, now you could do those kind of things and then they can then materialize in the next season or in the sequel to the film. It's a really great opportunity and a rare one where 1 and 1 equals 3 here. And to kind of replicate some of the success we've seen building fandom and with live events and consumer products, this actually fits really nicely into that. So I'm really excited to see where this goes.

The potentially big thing for games could be the IP expansion of their content. It’s likely that Netflix is trying replicate a Disney-like environment where the content translates into merchandise, dine-in restaurants, theme parks, and games. While possible, we’ll have to wait and see.

Disclaimer: Please note that none of the information provided constitutes financial, investment, or other professional advice. It is only intended for educational purposes. We have a vested interest in Netflix. Holdings are subject to change at any time.