Paycom Software Q2 2024 Earnings Update

BETI adoption picking up, international expansion underway, sales team ramping up and a healthy balance sheet

BETI continues to increase efficiency for clients

…One example is an existing client who has been with us for 6 years. This is a 2,500-employee company that recently adopted Beti. Since allowing their employees to do their own payroll, they reduced their payroll team by half, going from a process that took roughly 4 days before Beti to merely hours with Beti. Beti continues to evolve and raise the bar as we add more functionality and connections to solve complex decisioning. And we are seeing increased inbound inquiries from prospective clients….

BETI’s international expansion to Canada, Mexico, Ireland and the UK

…On the international front, we continue to make meaningful progress in the geographies that we rolled out in the last 12 months. Beti is now available for employees in Canada, Mexico, Ireland and the U.K. We continue to win new clients with domestic and foreign employees, thanks to our investments in our global HCM product and our native international payroll….

…[On adding more countries] As we develop them and as certain countries have certain factors that go into their own employment law, so -- but as we develop these countries, absolutely, we would expect that to be happening….

Clients in Canada are the only locally domiciled country that doesn’t have a US base connection

…Now you're asking if we've sold a client that has 0 U.S. employees and they're just in the country with 0 domestic employees? Is that your question? You may have fallen off. I'm going to answer that question. I assume it was. For sure, Canada, I believe we've had the clients that just have that. That was our first one released. I would be surprised at this point if we have a client just in Mexico or the U.K. or Ireland that doesn't have a U.S. base connection. But I would expect in Canada, we would have some of the talent….

BETI adoption continues to increase

…Yes, it continues to go up every month. I mean we're -- again, we're adding more and more clients. And each client that starts, they're starting with greater Beti usage than we have in the past. And so -- and those that are using it and have been using it, it continues to go up. And so with good technology that's easy to use, usage continues to move forward. Of course, we do have a percent of our client base still that may not be receiving the full benefit that it may have to offer at this point just because it's not the right time for them or what have you or it doesn't fit specifically with their initiatives. And so those clients are meeting them where they live.

And sometimes they do come on. Again, I talked on the call about a 2,500-employee company that finally said yes. It reduced their labor cost in regards to working the payroll system by half, and they went from 4 days of working on payroll to merely hours. So that's available to everyone out there. But again, we're servicing clients where they are right now today, and that's what we're focused on. And we'll move forward with clients on their time line, not ours. And then when it comes to new prospects coming in, we want them to receive the full value that we have to offer so that they can achieve that ROI, which is available only through Beti for new clients…

GONE automates the time-off process, saving time for clients

…GONE, the industry's first fully automated time-off solution, was recently recognized as a Globee award winner for transforming the time-off process. It connects highly complex, traditionally disparate solutions and leverages decisioning logic to automatically approve, deny or warehouse employee time-off requests. Time-off decisions are a hassle for everyone within an organization unless you use GONE.

Thanks to GONE, employees get immediate decisions, and managers gain back time and increased scheduling visibility. HR and payroll no longer have to track down managers to verify and decision requests. And GONE significantly reduces after-the-fact liabilities and related costs. The C-suite benefits from increased confidence in operations and resource management, driving improved productivity and reducing liability.

We have a retail client with over 100 stores where each managers control time-off requests differently. The client enabled GONE and built unique rules per store to ensure each manager was in control of their appropriate coverage. Now these managers no longer need to take direct action on request, and when the payroll team is prepping payroll, they've eliminated the need for all follow-ups. Their payroll manager stated, GONE to Beti to the next level. Since implementing GONE, this client has automated over 1,000 time-off decisions bringing up hours of nonproductive time. I'm very excited about GONE and its ability to streamline time-off requests for the businesses across the globe….

Ramping up the sales team

On the sales side, we are seeing strong momentum. Our new outside sales reps are winning more deals earlier than ever before, and we've sold significantly more units in 2024 than we did the same time last year. Just this month, we had our top sales week in company history. Sales is energized. And last week, we added our largest sales class of new reps, placing 67 sales reps in the field across the country. I'm excited about the enthusiasm across our sales division heading into the back half of the year….

…So we're better staffed in sales than what we've been in probably 5 or 6 years. And what I mean by that is having all teams with the sales manager in it, fully staffed, and then just the number of staff that we have on each. And so Amy Vickroy took over sales and had been with us for 14 years prior to that. She took over sales in April, and since that time, has really got them in a position -- us in a position on the sell side where we're strong from a staffing perspective, and again, our sales tactics and techniques to be able to go out there and even sell more as we're differentiated in the industry….

Strategy is to maximize value for the client before upselling more products

And so it really depends on if I'm working with the client that has not yet gone through the client value achievement strategy fully or if I'm working with the client that has.

And so that's not to say that they can't provide opportunity and additional -- that they don't have additional revenue opportunities with each client. It's just there are certain methods that we go through today to ensure that clients are achieving that before we just sell them.

Paycom focuses on solving and automating problems for clients first, subsequently discovering the revenue opportunity

And so I guess we focus on problems to solve and what we want to automate. That's where we start regardless of whether or not that's in our current system of innovation or whether or not that's something new that we had. And so we start with what problem are we solving. And so when you're looking at automation, it's across the entire suite.

But it will include additional module opportunities. But those develop as you're doing the right thing, and then you're at the end of your process, you're able to discover the ROI for each and see if there is a revenue opportunity for that. We don't start with the revenue opportunity. We start with automating problems for our clients and solving problems. And sometimes, we get to share in those problems we solve through additional revenue opportunities.

Opportunistically buying back shares at lower prices

…During the second quarter and into July, the valuation of our stock dropped below that of slower growth and lower margin peers. We opportunistically took advantage of the low stock price to repurchase approximately 790,000 shares between April 1 and July 31 for $120 million. Since July 1 of last year, we have repurchased approximately 2.3 million shares, representing approximately 4% of total shares outstanding. Nearly 2 million of that has been repurchased since November of last year. Earlier this week, we increased our buyback authorization to $1.5 billion and extended it for another 2-year period. We will continue to be opportunistic buyers of our stock if and when we see dislocations in valuation relative to our peers…

Capex to be 11-12% of revenue for 2024; to be single digits for 2025

…Yes. I mentioned that we just finished the last building. We've got a couple more projects throughout the end of the year. So kind of as we talked earlier, what we thought the percent would be for the year, somewhere in that 11% to 12%, probably still thinking that. As we look at next year, we really don't have any large projects on the plan. So we mentioned even on the last call that we would expect CapEx to be potentially single digits next year as a percent of revenue….

Takeaway

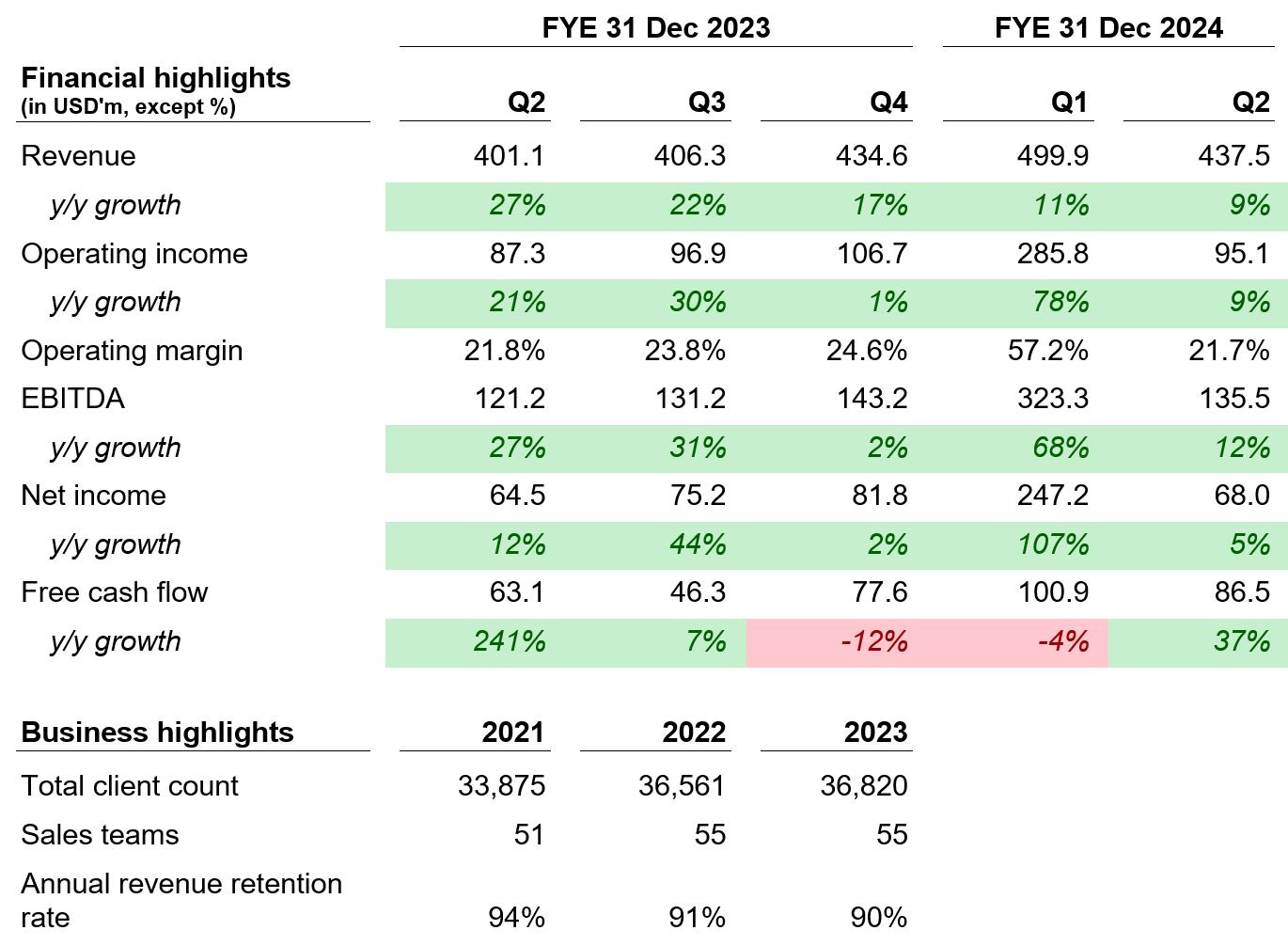

While revenue growth continues to take a headwind from BETI’s cannibalization, Paycom’s financials are solid with strong free cash flow generation and a healthy balance sheet with no debt. BETI adoption continues to pick up and international expansion is underway. The extent that BETI increases efficiency for clients, more so than the competition, is the extent that they should be successful. In our view, management is taking the long-term view with BETI. Lowering costs for customers through BETI will mean less revenues for Paycom, in the short-term. Taking a longer perspective though, adding more value to the customer and gaining their trust could lead to much bigger gains. The focus on the customer is spot on, and this quote by Jeff Bezos, founder of Amazon feels appropriate:

"If you're long-term oriented, customer interests and shareholder interests are aligned."

At the current valuation, the market is pricing in the lower growth rates, leaving opportunity for Paycom to surprise on the upside. The company has also been buying back shares rather aggressively. As Paycom continues to execute well on adding new clients, expanding to new countries and cross-selling more products, the drawdown in stock price could be an opportunity for long-term investors in hindsight.

Disclaimer: Please note that none of the information provided constitutes financial, investment, or other professional advice. It is only intended for educational purposes. We have a vested interest in Paycom Software Inc. Holdings are subject to change at any time.