Some cheap stocks on the Hong Kong Stock Exchange

Cigar butt or value trap?

I’ve never really seen live “net-nets”, a term developed by Ben Graham where a company is valued at less than its liquidation value or net current assets. So I thought it’d be fun to have a look at the small caps in one of the most disliked markets in the world by Western investors: China.

While accounting fraud and corruption may be more visible in China, fraud risk exists in every market. Investors should always maintain a level of skepticism, and China is no exception.

To be clear, these businesses are not fantastic; most operate in a low-technology manufacturing industry, have structural headwinds and low or no-growth potential, and are very small caps. But I was just fascinated with the market valuation so I thought I’d share them here. At best, these could be a cigar butt investing play and at worst, a value trap.

China Starch Holdings Limited (3838.HK)

China Starch is a company that manufactures and sells cornstarch, lysine, starch-based sweeteners, modified starch, and ancillary corn-based and corn-refined products in China. They operate in two segments: Upstream, and Fermented and Downstream products. The Upstream segment is the main business but there’s a lot of cyclicality in their pricing due to the demand and supply of their products, leading to fluctuations in margins over the years. Management has announced plans to increase production capacity of cornstarch from 1 million to 1.55 million tonnes, and a thermal power project to provide steam and electricity without relying on third parties and lowering operational costs over time.

China Starch’s revenue has reached new levels with their expansion in production capacity with a 10-year CAGR of 10.9%. However, in recent years, growth has been rather muted, with revenue showing a 3-year CAGR of 2.7%. Operating margins are generally low, ranging between 3-5%. The dividend yield is about 3.3%.

So what’s the valuation? China Starch trades at a market cap of HKD1.3b (USD175m), with a P/E of 3.6. Their net cash position is HKD1.09b (USD140m), or ~80% of market cap. Cheap, but subject to the volatility of the market prices of cornstarch and cornstarch derived products.

Emperor Watch & Jewellery Limited (887.HK)

Emperor’s business is in retailing European-made watches and self-designed fine jewelry products under the Emperor Jewellery brand name. Most of their customers are in China, with 53% in Hong Kong, 28% in the PRC, 13% in Singapore and Malaysia, and 6% in Macau.

Revenue has rebounded from Covid lows with a 3-year CAGR of 10.6%. The business runs with operating margins at 7-8%. Recently, management announced plans to acquire the remaining floors of a five story building on a prime street in Hong Kong with plans to transform it into a flagship mega store for a luxury watch retailer.

Emperor’s market cap is HKD1.24b (USD160m), with net cash of HKD280m (USD36m) and high insider ownership (~63%). It trades at a P/E of 3.8 and a dividend yield of 7.6%.

Cirtek Holdings Limited (1433.HK)

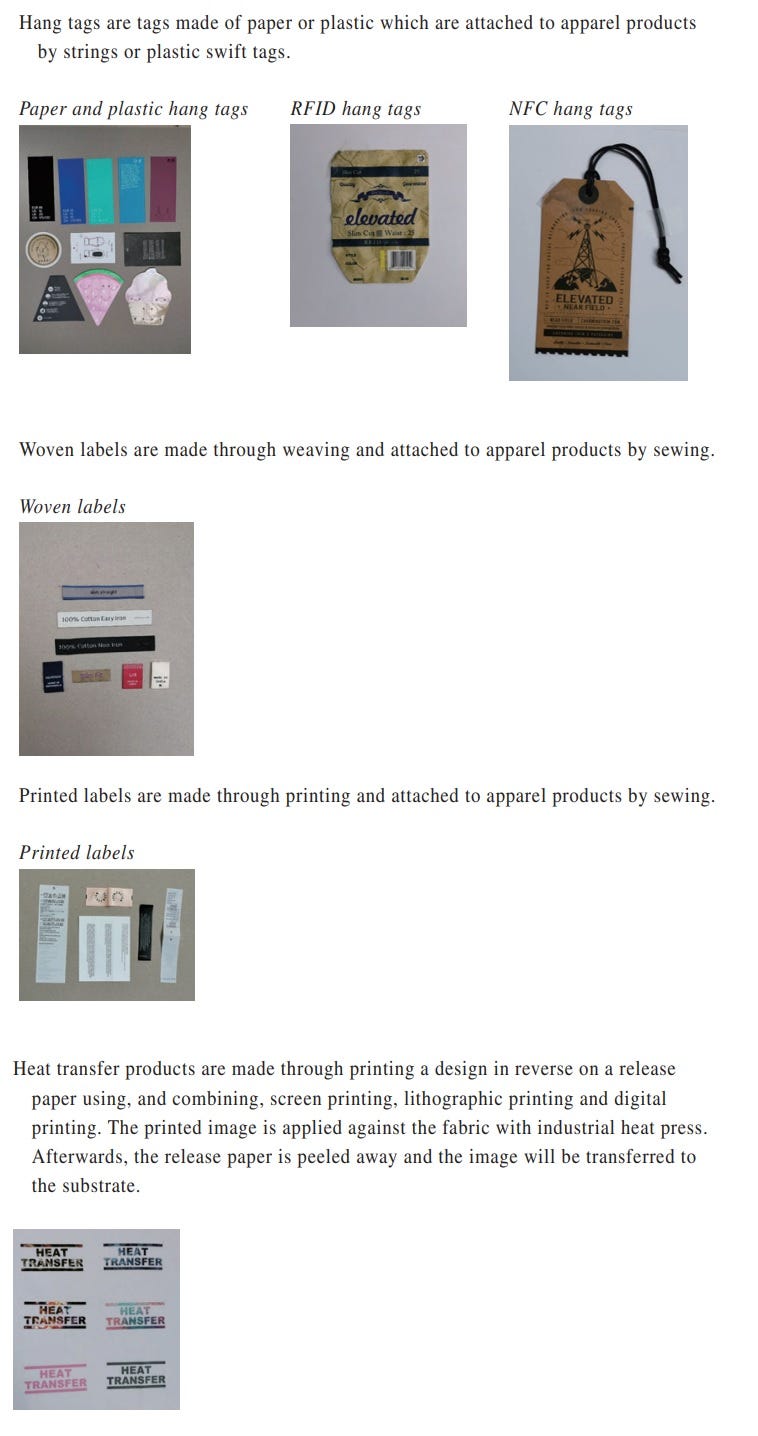

Cirtek manufactures and sells printing products in Hong Kong, Macau, PRC, Bangladesh, Vietnam, the US, and internationally. The company offers apparel labels and trim products, such as hang tags, woven and printed labels and heat transfer products. Some examples of their products below:

Cirtek mainly sells to apparel manufacturers which handle the manufacturing process for the apparel brands. There’s an increasing trend of embedding the hang tags and labels with RFID and NFC tags to facilitate inventory management of apparel manufacturers or apparel brands, which is a more efficient way of managing inventory in warehouses and retail stores. The application of RFID and NFC tags would enhance data management and supply chain management for global apparel brands.

Cirtek is a newly-listed company that had its IPO in 2020 to raise funds to upgrade their factory in Bangladesh. Cirtek has production facilities in the PRC, Bangladesh and Vietnam, as well as a supporting production line for encoding RFID products in the US.

Previously, Cirtek had some issues with securing contracts from apparel brands due to the fact that the company’s Bangladesh factory operated in a shared factory building and limited variety of machine types. The upgraded factory would have a total gross floor area of approximately 10,600 sq. m, up from 3,300 sq. m. Management expects a payback period of approximately 7.3 years after the new factory commences operations, with an expected IRR of 22%. The company announced that this factory has commenced operations at the end of 2023.

What’s interesting about Cirtek is that their 3-year revenue CAGR was essentially flat at 0.69%, from 2021 to 2023. However, in 1H of 2024, taking into account the impact of the new factory, revenue increased by 65.1%. While writing this analysis, management recently guided to a profit before tax of HKD65m (USD8.36m) for the full year 2024, up from a loss of HKD19.7m (USD2.53m) in the previous year (And the stock jumped 30% the next trading day!).

Even after the jump, the company trades at a market cap of HKD229m (USD30m), with a net cash of HKD15m (USD1.93m), no dividends paid in 2024, and a P/E of 9.1.

Hyfusin Group Holdings Limited (8512.HK)

Hyfusin is in the business of designing, manufacturing, and selling candle products in the US, UK and internationally. The company provides daily-use candles, scented candles, and decorative candles as well as other products including diffusers. It primarily serves department store operators and buying agents.

Hyfusin customers are mainly outside of China, with majority of sales to the US (93%) and the remaining to the UK (7%). The company’s valuation metrics are interesting: market cap of HKD284 (USD37m), net cash of HKD234m (USD m), no dividend yield and a P/E of 2.4. The business has a high insider ownership of ~70%, with ~15% net margins.

There’s a similar expansion story here with their 3rd factory expected to commence in the second half of 2024. However, there’s significant customer concentration risk though, as most of their revenue come from their top three customers: Customer A (63%), Customer B (10%), and Customer C (7%).

Final words

I find it interesting that these are cash generating, profitable businesses, that are trading at really cheap valuations. I’m treating this more as a case study, as I’d personally need to know much more about management to be able to bet on them. But it’s funny how market inefficiencies start to appear especially when you swim around the small/micro caps in an unloved market.

Disclaimer: Please note that none of the information provided constitutes financial, investment, or other professional advice. It is only intended for educational purposes.