The Trade Desk: Leading the Charge in CTV as Advertisers Embrace Premium Content and Data-Driven Precision

The Trade Desk (TTD) Q3 2024 Earnings Analysis

Table of Contents

About The Trade Desk

Business Analysis

Financial Analysis

Earnings Call Highlights

Takeaway

1. About The Trade Desk

The Trade Desk is a self-service, omnichannel cloud-based software platform that enables advertisement buyers to create, manage, and optimize more expressive data-driven digital advertising campaigns across ad formats, including display, video, audio, native and social, on a multitude of devices, such as computers, mobile devices, and connected TV (“CTV”).

The company serves advertising agencies and other service providers for advertisers. The company mainly generates revenue by charging clients a platform fee based on a percentage of the client’s total spend on advertising.

2. Business Analysis

Client Retention

In Q3 2024, client retention rate was more than 95%, which was the case for the past 10 years consecutively.

Geographical Revenue Mix

The revenue mix was 88% in US and 12% in International, stable compared to last quarter.

Updates on UID2:

Spotify partnership extension; piloting integrations with OpenPath and UID2 through Spotify Ad Exchange

Roku’s adoption of UID2; advertisers can have more precise targeting with Roku Media

Reach, a UK news publisher of 130 media brands, is adopting EUID

Global media company Motorsport Network’s adoption of EUID

Global Research Marketplace, Cint’s integration of UID2

3. Financial Analysis

Revenue

The Trade Desk delivered revenue of $628 million, representing a 27% year-over-year increase. This growth was mainly driven by higher gross spend in the current year on the platform, which in turn was driven by new clients, more campaigns executed by existing clients and higher spend per campaign.

Profitability

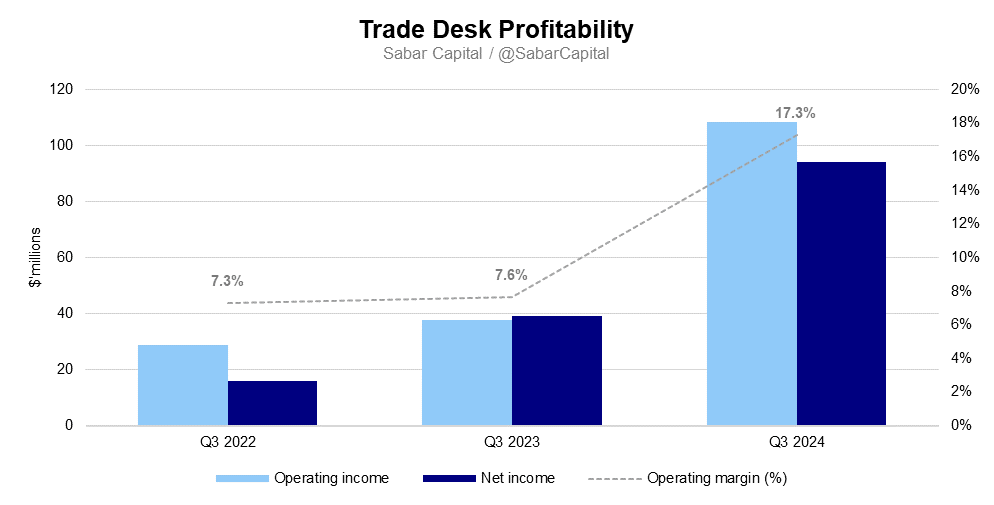

The Trade Desk reached an operating income of $108 million in Q3 2024, up 188% y/y.

Operating expenses increased by $29 million to $519.5 million, up 31% y/y, mainly due to platform operations expense and sales and marketing.

Platform operations expense increased by $29 million, or 23% y/y mainly driven by a $22 million increase in hosting costs and a $6 million increase in personnel costs. The increase in hosting costs was due to support costs related to:

the increased use of the platform by clients;

increased use of features by the company’s technical teams in platform support; and

investment in new data centres to support the continued platform growth.

Sales and Marketing expense increased by $28 million, or 25% y/y due primarily due to an increase in personnel costs related to headcount growth to support sales efforts and to continue to develop and maintain relationships with clients, an increase in incentive compensation driven by gross spend growth, and an increase in travel costs. In the future, management expects sales and marketing expenses to increase in absolute dollars, as the focus on increasing the platform adoption with existing and new clients, as well as expanding the international segment.

As a result of revenue increasing by $135 million, almost double compared to operating expenses of about $64 million, operating margin improved significantly to 17.3%, up from 7.6% a year ago.

Free Cash Flow

In Q3, the Trade Desk delivered a free cash flow of $224.6 million, representing a 20% increase y/y. Over the past 12 months, free cash flow was $527.9 million, with a free cash flow margin of 22.9%.

Balance Sheet

The Trade Desk’s cash and cash equivalents including short-term investments was $1.7 billion, with no debt. Absolutely rock solid.

4. Earnings Call Highlights

CTV inventory is no longer scarce, advertisers have more choice and require more insight; UID2 and OpenPath help to provide this signal

You may recall, three or four years ago, I would talk on these calls about inventory scarcity, especially in CTV in the fourth quarter, which was enjoying a significant surge because of people spending more time streaming at home during the global pandemic.

As advertisers chased those viewer eyeballs to new streaming platforms, advertising inventory was scarce and with demand rising, CPMs went up. But CTV inventory isn't scarce in the same way anymore. Because over the last couple of years, every major media company has launched a streaming service, and all of them have embraced advertising as a key way to fund their content and grow. As inventory scales and scarcity decreases, advertisers have a lot more choice.

They also have a harder job, which is assigning value to a lot more inventory. Now, it's about the quality of the inventory as well as the quality of the signal. You may remember at our last Investor Day, that we showed a graph of what our clients were willing to pay for CTV ad impressions on the open market. In many cases, we've been significantly higher than the price that the media companies were negotiating in direct deals.

The content arms race is more intense and more expensive than ever, and media companies need to monetize their content as effectively as possible. Two weeks ago, Variety reported that the top six media companies will increase content spending this year by 9% to a record $126 billion, all of which needs to be funded. Without the benefit of scarcity, media companies now need to provide advertisers with more insight. What am I buying? Who am I reaching? Tools like UID2 and OpenPath, are helping provide that signal.

The best is yet to come for partnerships with Netflix, Disney, Roku, Fox and Spotify

One other thing that also gives me a tremendous amount of optimism for the future is that some of our most significant partnerships, whether that's Netflix or Disney or Roku or Fox or Spotify are all in what I would call the crawl phase of our partnership. We've done some amazing themes with some of those. Others, we've always talked about doing amazing things and we've done just sort of testing the pipes.

But I think the very best is yet to come in all of those partnerships. And so, in the short term, they're making small contributions, but I think the very best is yet to come and all of that, and I'm sure we'll talk about OpenPath and some other things later. But that gives you a sense of what we're facing in the short term.

Amazon may be at a bigger disadvantage in CTV if they neglect premium content that others own

Amazon operates at a much bigger disadvantage in CTV than in any other channel. So, we've argued against Google's lack of objectivity in every other part of the open Internet, and they've been less of a competitor in CTV. Amazon has been more of a competitor in CTV, but I think Google was a more formidable competitor in the other parts of the open Internet than Amazon is in CTV and that is simply because of that conflict of interest. They are going to be pushing ads on premium content that they own, meanwhile, neglecting premium content that others own, while we have no dog in the hunt, and we're just trying to help people objectively decide, do I buy the ad on Netflix or do I buy the ad on Hulu or Tubi or somewhere else.

Political spend should be in the low single digits of overall spend for 2024

We went into the last political cycle, the last big one back in 2020 saying that political spend was in the mid-single digits, and we believe for this year of 2024, it will be in the low single digits as a percent of our overall spend. When we think about how we consider political in Q4 and then go into thinking about how we're modeling going into 2025, it's a really nuanced but important question this year. Typically, what we see is that Q1 is, on average, a 22%, 23% sequential decline from Q4.

And in political years, it's critical to exclude that political contribution in Q4 which we believe, again, will be a low to mid-single-digit percent for that quarter as we go into modeling Q1 of 2025.

Sports and programmatic ads could go hand in hand

Of course, sports is some of the most premium and most expensive content and media. Because it is often scarce and often highly sought out by brands, and it changes very quickly, it really is built for programmatic advertising. The best moments in sports are surprises and unpredictable. That's what makes them so exciting.

However, it's also what makes them hard to plan around and to price properly. I expect over the coming years to see programmatic spot markets and sports become best friends. We are enjoying our strongest year to date with live sports as the football season has kicked off here in the United States, we are looking at, on average, 1.5 billion ad impressions per weekend. We have dozens of major brands buying football through our platform for the first time and many others increasing spend in the triple-digit range.

5. Takeaway

Strong quarter from The Trade Desk. They remain well positioned for long-term growth, driven by its robust financial performance, strategic focus on macro tailwinds like CTV, retail media, audio, live sports, and international expansion. The company’s sustained and increasing profitability, strong cash flow, and impressive client retention rate clearly shows the effectiveness and strength of the business. The company’s commitment to innovation and its objective approach to providing advertisers with valuable insights should continue to drive its growth.

Disclaimer: Please note that none of the information provided constitutes financial, investment, or other professional advice. It is only intended for educational purposes. We have a vested interest in The Trade Desk Inc. Holdings are subject to change at any time.