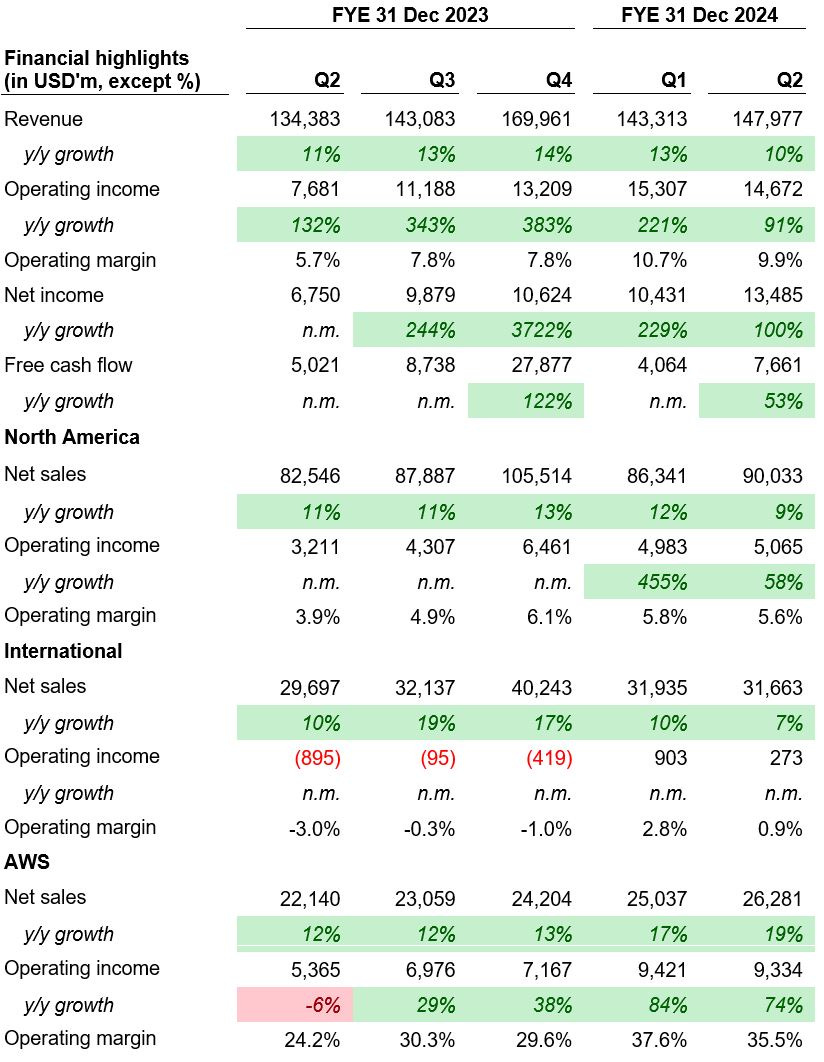

Amazon Q2 2024 Earnings Update

Focused on lowering cost to serve while still investing for the future

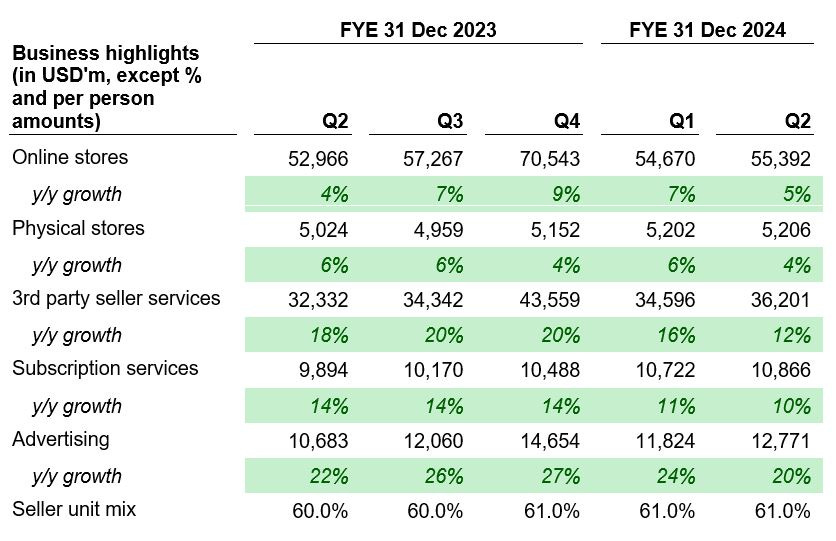

Stores

Improved operating margin for North America stores business

If we look at profitability of the core North America stores business, we actually improved our margin again quarter-over-quarter in Q2. The overall North America segment operating margin decreased slightly due to increased Q2 spend in some of our investment areas, including Kuiper, where we're starting to manufacture satellites we'll launch into space in Q4…

North American unit growth meaningfully outpaced sales growth

While consumers are being careful on price, our North American unit growth is meaningfully outpacing our sales growth, as our continued work on selection, low prices and delivery is resonating. So far this year, our speed of delivery for Prime customers has been faster than ever before, with more than 5 billion units arriving the same day or next day.

The Amazon flywheel: Focus on lowering cost to serve improves selection, further providing the opportunity to lower cost to serve

…I continue and the team continues to believe that we have the opportunity to expand the margin in our Stores business. And as I've said on a number of the calls that we've done, it's not going to happen in 1 quarter. It's not going to happen in one fell swoop. It's going to take work over a long period of time.

But I think that 1 of the silver linings, if you will, about 1.5 years ago in the ricochet of the pandemic and all the growth that we had and the cost to serve challenges that we had was it really forced us to reevaluate everything in the network and really, even our most closely felt beliefs over a long period of time. And what it did was it unveiled a number of opportunities that we believe we have to keep driving cost to serve down.

And the first one that you've seen play out over the last year or so has been the regionalization of the U.S. network. And I think one thing to remember about that is that while it's had even bigger impact than maybe we theorized when we first architected it, we're still not done fully honing it. There's a lot of ways that we continue to optimize that U.S. regionalization that we think will continue to bear lower cost to serve.

But at the same time, we found a number of other areas where we believe we can take our cost down while also improving the customer experience. One of the great things about regionalization was it not only took our cost to serve down, but it meaningfully changed the speed with which we're able to get items to customers. And so we have a number of those other opportunities.

Another example of that is regionalizing our inbound network, which is also going to lower our cost to serve and get items more close to end users and diminish the amount of time it takes to get them to customers. We have a number of things that we're working on that allow us to combine more units per box, which lowers our costs as well and a lot of customers like that better because it's better for the environment, having more units per box.

So I think we have a lot of opportunities to continue to take down our cost to serve. And strategically and philosophically, just 2 other things as you were alluding to that question. I think that from our perspective, as we're able to take cost to serve down, it means that we're able to afford to have more selection that we're able to offer to customers. And there are a lot of lower ASP items there, average selling price items, that we don't stock because they're not economic to stock with our current cost to serve.

But as we work hard to make progress like we are on lowering our cost to serve, that allows us to add more selection. And we see this time in and time out that we add -- when we add more selection, customers actually consider us for more of their purchases and spend more with us down the line.

By lowering cost to serve, Amazon can add more low average selling price (ASP) selection

As we lower our cost to serve, we can add more low ASP selection that we can support economically, which, coupled with our fast delivery, puts Amazon in the consideration set for increasingly more shopping needs for customers.

International segment’s path to profitability

…This [operating margin] increase is primarily driven by our established countries as we improve our cost structure with better inventory placement and more consolidated shipments. Additionally, our emerging countries continue to expand their customer offerings, leverage their cost structure and invest in expanding Prime benefits. We are pleased with the overall progress of these countries as they make strides on their respective paths to profitability…

…You mentioned we're at about $300 million profit for the quarter. That is up about 390 basis points year-on-year from a margin perspective. And as we talked about in the past, there's a number of countries at different stages of existence and maturity there. And so I think you're seeing continued progress certainly on a year-over-year basis with both our established countries.

So the U.K., Germany and Japan, in particular being sizable contributors to that business, continued improvement and build out there, similar to the factors we talked about with the U.S., focused on operational efficiency while expanding the customer experience. And then in the emerging countries, as we've said over the past several quarters, we launched about 10 countries over the last 7 years, really focused on, again, expanding that customer experience, building out the Prime member benefits while building scalable solutions for customers. And so I think in both that established and emerging areas, seeing good progress year-over-year and working for further improvement there…

Advertising

Aim to have meaningfully fewer ads by improving relevance and performance. Advertising is already a >$50b annual run rate business, but it’s only beginning

For perspective, we've added over $2 billion in advertising revenue year-over-year and generated more than $50 billion in revenue in the trailing 12 months. Sponsored ads drive the majority of our advertising revenue today, and we see further opportunity there. Even with this growth, it's important to realize we're at the very beginning of what's possible in our video advertising.

In May, we made our first appearance at the upfronts, and we're encouraged by the agency and advertiser feedback on the differentiated value we offer across our content, reach, signals and ad tech. With ads and Prime Video, the exciting opportunity for brands is the ability to directly connect advertising that's traditionally been focused on driving awareness, as is the case for TV, to a business outcome like product sales or subscription sign-ups.

We're able to do that through our measurement and ad tech, so brands can continually improve the relevance and performance of their ads. While ads have become the norm to streaming video, we aim to have meaningfully fewer ads than linear TV and other streaming TV providers. And of course, for customers preferring an ad-free experience, we offer that option for an additional $2.99 a month.

Advertising is a key contributor to profitability

Advertising remains an important contributor to profitability in the North America and international segments. And we saw strong growth on an increasing larger revenue base this quarter. We continue to see opportunities that further expand our offering in areas that are driving growth today like sponsored products as well as newer areas like Prime Video ads.

AWS

AWS growth is reaccelerating as companies’ cost optimization efforts are mostly over, the shift from on-prem to cloud continues, and companies are looking to leverage AI

We're continuing to see 3 macro trends drive AWS growth. First, companies have completed the significant majority of their cost optimization efforts and are focused again on new efforts.

Second, companies are spending their energy again on modernizing their infrastructure and moving from on-premises infrastructure to the cloud. This modernization enables builders to save money, innovate at a more rapid clip and drive productivity in most companies' scarcest resources, developers. This is the flip I've talked about in the past, where the vast majority of global IT spend today is on-premises, and we expect that to keep inverting over time. With the broadest functionality, the strong security and operational performance and the deepest partner ecosystem, AWS continues to be customers' partner of choice and the biggest beneficiary of this flip from on-premises to the cloud.

And third, builders and companies of all sizes are excited about leveraging AI. Our AI business continues to grow dramatically with a multibillion-dollar revenue run rate despite it being such early days, but we can see in our results and conversations with customers that our unique approach and offerings are resonating with customers.

… But I do think that we have seen the lion's share of the cost optimization happen.

And I also do believe that pre-pandemic we were on this march where most companies are trying to figure out how to modernize their infrastructure, which really means moving from on-premises to the cloud because they can save money and invent more quickly and get better developer productivity. And then the pandemic happened, and people were in survival mode. And then a difficult economy came, and people were trying to save money. And we just see people going back to asking themselves why aren't we taking this low hanging fruit here. I mean it makes -- I don't want to run my own data centers. I can actually be more cost effective and invent more quickly for my customers if I'm using the cloud. And AWS with just a lot more functionality, stronger operational performance and security, which really matters to customers as well and a deeper partner ecosystem continues to be the partner of choice as people are moving to the cloud.

And I think the generative AI component is in its very early days. It's -- as I said, we kind of sometimes look at it and say that it's interesting that we have a multibillion-dollar revenue run rate already in AI, and it's so early. But if we look at the amount of demand that we have from customers right now, it's very significant. So I think all 3 of those things have a chance and will likely continue over time. And we'll see where that growth rate nets out over the next number of years.

I think that the -- one other thing I would say about that, too, Mark, is that the business today, as I mentioned, it's a $105 billion revenue run rate business. About 90% of the global IT spend is still on-premises. And if you believe that equation is going to flip, which I do, there's a lot of growth ahead of us in AWS as the leader in all those dimensions I mentioned. But I also think that generative AI itself and AI as a whole, it's going to be really large.

I mean it is not something that we originally factored when we were thinking about how large AWS could be and unlike the non-AI space, where you're basically taking all of this infrastructure that's been built on premises over a long period of time and working with customers to help them migrate it to the cloud, which is a lot of work by the way, in the generative AI space, it's going to get big fast, and it's largely all going to be built from the get-go in the cloud, which allows the opportunity for those businesses to continue to grow…

On right-sizing capacity for AI investments: Amazon’s receiving significant early signals that customers need more capacity

I think on the question about investment in AWS and on the AI side, I think where I'd start is, I think, one of the least understood parts about AWS over the last 18 years has been what a massive logistics challenge it is to run that business.

If you think about the fact that we have about 35 regions and think of a region as multiple -- a cluster of multiple data centers and about 110 availability zones, which is roughly equivalent to a data center, sometimes it includes multiple and then if you think about having to land thousands and thousands of SKUs across the 200 AWS services in each of those availability zones at the right quantities, it's quite difficult. And if you end up actually with too little capacity, then you have service disruptions, which really nobody does because it means companies can't scale their applications.

So most companies deliver more capacity than they need. However, if you actually deliver too much capacity, the economics are pretty woeful, and you don't like the returns of the operating income. And I think you can tell from having -- we disclosed both our revenue and our operating income in AWS that we've learned over time to manage this reasonably well. And we have built models over a long period of time that are algorithmic and sophisticated that land the right amount of capacity. And we've done the same thing on the AI side.

Now AI is newer. And it's true that people take down clumps of capacity in AI that are different sometimes. I mean -- but it's also true that it's not like a company shows up to do a training cluster asking for a few hundred thousand chips the same day. Like you have a very significant advanced signal when you have customers that want to take down a lot of capacity.

So while the models are more fluid, it's also true that we've built, I think, a lot of muscle and skill over time in building these capacity signals and models, and we also are getting a lot of signal from customers on what they need. I think that it's -- the reality right now is that while we're investing a significant amount in the AI space and in infrastructure, we would like to have more capacity than we already have today. I mean we have a lot of demand right now, and I think it's going to be a very, very large business for us…

…For the first half of the year, CapEx was $30.5 billion. Looking ahead to the rest of 2024, we expect capital investments to be higher in the second half of the year. The majority of the spend will be to support the growing need for AWS infrastructure as we continue to see strong demand in both generative AI and our non-generative AI workloads…

Custom silicon improves price performance for customers

On the custom silicon point, it's really interesting what's happened here. And it's also our strategy and approach here has been informed by running AWS for 18 years. When we started AWS, we had and still have a very deep partnership with Intel on the generalized CPU space. But what we found from customers is that they -- when you find a -- an offering that is really high value for you and high return, you don't actually spend less, even though you're spending less per unit. You spend less per unit, but it enables you, it frees you up to do so much more inventing and building for your customers. And then when you're spending more, you actually want better price performance than what you're getting.

And a lot of times, it's hard to get that price performance from existing players unless you decide to optimize yourself for what you're learning from your customers and you push that envelope yourself. And so we built custom silicon in the generalized CPU space with Graviton, which we're on our fourth model right now. And that has been very successful for customers and for our AWS business, is it saves customers about -- up to about 30% to 40% price performance versus the other leading x86 processors that they could use.

And we saw the same trend happening about 5 years ago in the accelerator space in the GPU space, where the products are good, but there was really primarily 1 provider and supply was more scarce than what people wanted. And people -- our customers really want improved price performance all the time. And so that's why we went about building Trainium, which is our training chip, and Inferentia, which is our inference chip, which we're on second versions of both of those. They will have very compelling relative price performance.

And in a world where it's hard to get GPUs today, the supply is scarce and all the schedules continue to move over time, customers are quite excited and demanding at a high clip, our custom silicon, and we're producing it as fast as we can. I think that's going to have very good return profile just like Graviton has, and I think it will be another differentiating feature around AWS relative to others.

Prime Video and Live Sports

Emmy nominations and the NBA deal

Our storytelling is resonating with our hundreds of millions of monthly viewers worldwide, and the 62 Emmy nominations Amazon MGM Studios recently received is another supporting data point…

…And we continue to see momentum in live sports. We recently announced 11-year landmark deals with the NBA and the WNBA.

Pharmacy

Expanded RxPass to MediCare members

On the pharmacy side, I think you're right that you're seeing that business continue to grow and to get more resonance with customers. And I think it was always a relatively natural extension for us to build a pharmacy offering from our retail business. But I think a lot of what you see in the business has grown really quickly, a lot of what you've seen is that the work that the team has done on the customer experience over the last 18 months has really paid off.

Customers love the customer experience of Amazon Pharmacy. And we -- especially, by the way, when you think about the experience and the speed and ease with which you can order versus walking into a pharmacy, in a physical store, if you walk into pharmacies and -- in cities today, it's a pretty tough experience with how much is locked behind cabinets, where you have to press a button to get somebody to come out and open the cabinets for you and a lot of shoplifting going on in the stores.

So the combination of what's happening in the physical world and how much improved we've made our pharmacy experience is driving a lot of customer resonance and buying behavior, I think also you see us continuing to expand there. We expanded our RxPass package and program to Medicare members, and that program allows customers and members to be -- Prime members to be able to get up to 60 common medications for just $5 a month. And we continue to launch same-day delivery of medications to cities. We have them in 8 cities, including Los Angeles and New York today with plans to expand to more than a dozen cities by the end of the year. So we're seeing a lot of growth there, and we're very optimistic about it.

Project Kuiper

Expect to start shipping production satellites end 2024

…for Project Kuiper, our low Earth orbit satellite constellation, we're accelerating satellite manufacturing in our facility in Kirkland, Washington. We've announced a distribution agreement with Vrio who distributes DIRECTV Latin America and SKY Brazil to offer Project Kuiper satellite broadband network to residential customers across 7 countries in South America. And we continue to field significant demand for the service from enterprise and government entities. We expect to start shipping production satellites late this year and continue to believe this could be a very large business for us.

Takeaway

A very solid quarter for Amazon with low double digit revenue growth (keeping in mind that Amazon’s annual revenue is more than half a trillion dollars), expansion in operating margin as the company manages their costs, and strong free cash flow generation. The North America segment expanded operating margin and management believes there’s room for further expansion. The International segment’s path to profitability remains on track. Advertising is already a $50 billion ARR, high margin business that is still in the early stages. AWS growth continues to pick up with cost optimization efforts largely being over and companies being excited about AI. Moreover, the Amazon flywheel continues to be in effect as the company reinvests to lower cost to serve and returning value to the customer, which only further enhances Amazon’s gigantic moat. While already a huge business, Amazon remains a core holding with lots of opportunity for growth.

Disclaimer: Please note that none of the information provided constitutes financial, investment, or other professional advice. It is only intended for educational purposes. We have a vested interest in Amazon.com Inc. Holdings are subject to change at any time.